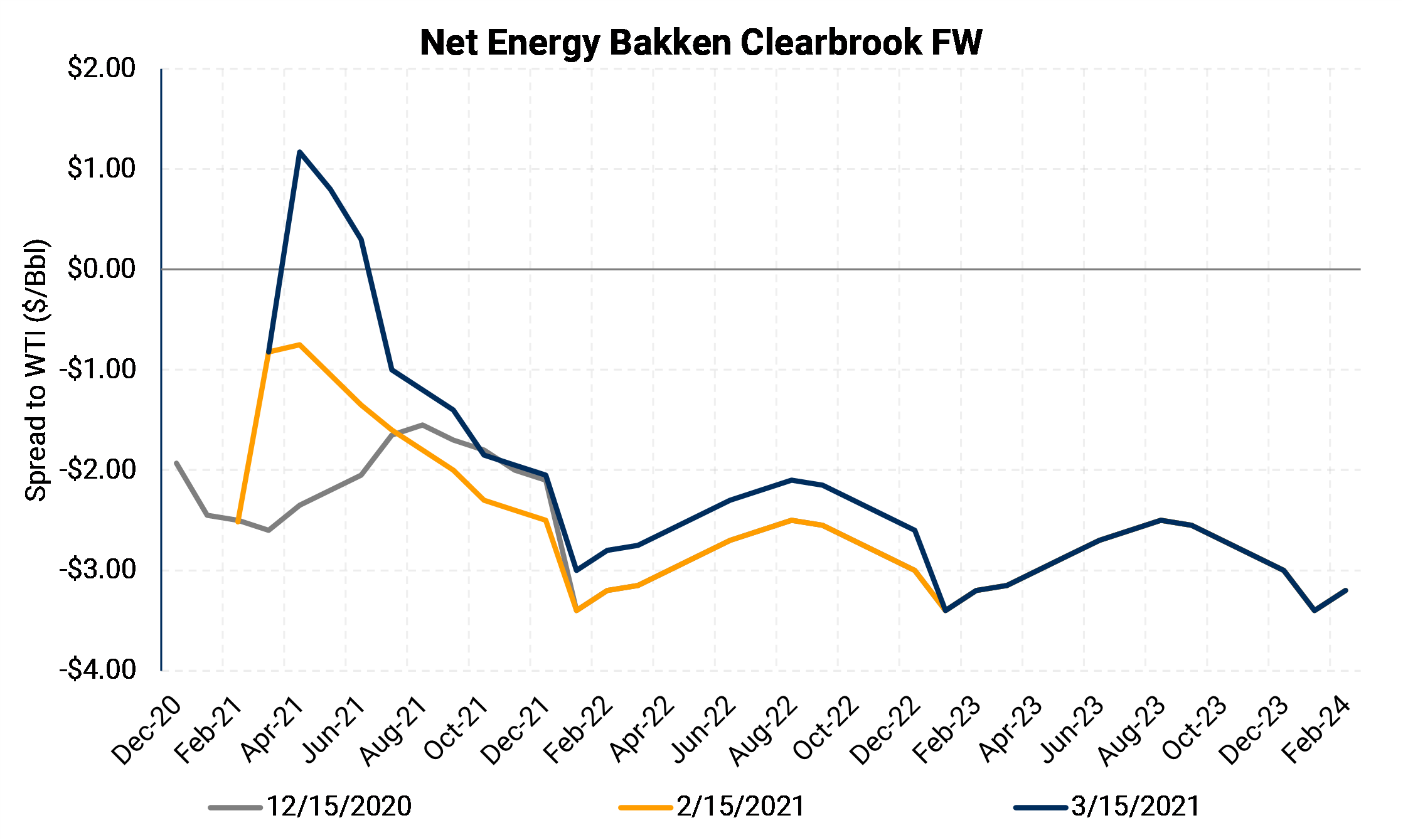

Since mid-February, Bakken Clearbrook prices have rallied into positive territory versus WTI for the first time since April 2020. Weather-induced supply disruptions have been the main contributor to the positive Bakken differentials. North Dakota oil production was affected by the frigid temperatures that hammered most of the central U.S. during February. The surge in price has occurred mainly in the nearby months of the curve, as evidenced by the chart above. Still, only the Apr 2021, May 2021, and Jun 2021 contracts are in positive territory. When supply returns or a court decision is made on the DAPL pipeline, prices could weaken.

The surge in price has occurred mainly in the nearby months of the curve, as evidenced by the chart above. Still, only the Apr 2021, May 2021, and Jun 2021 contracts are in positive territory. When supply returns or a court decision is made on the DAPL pipeline, prices could weaken.

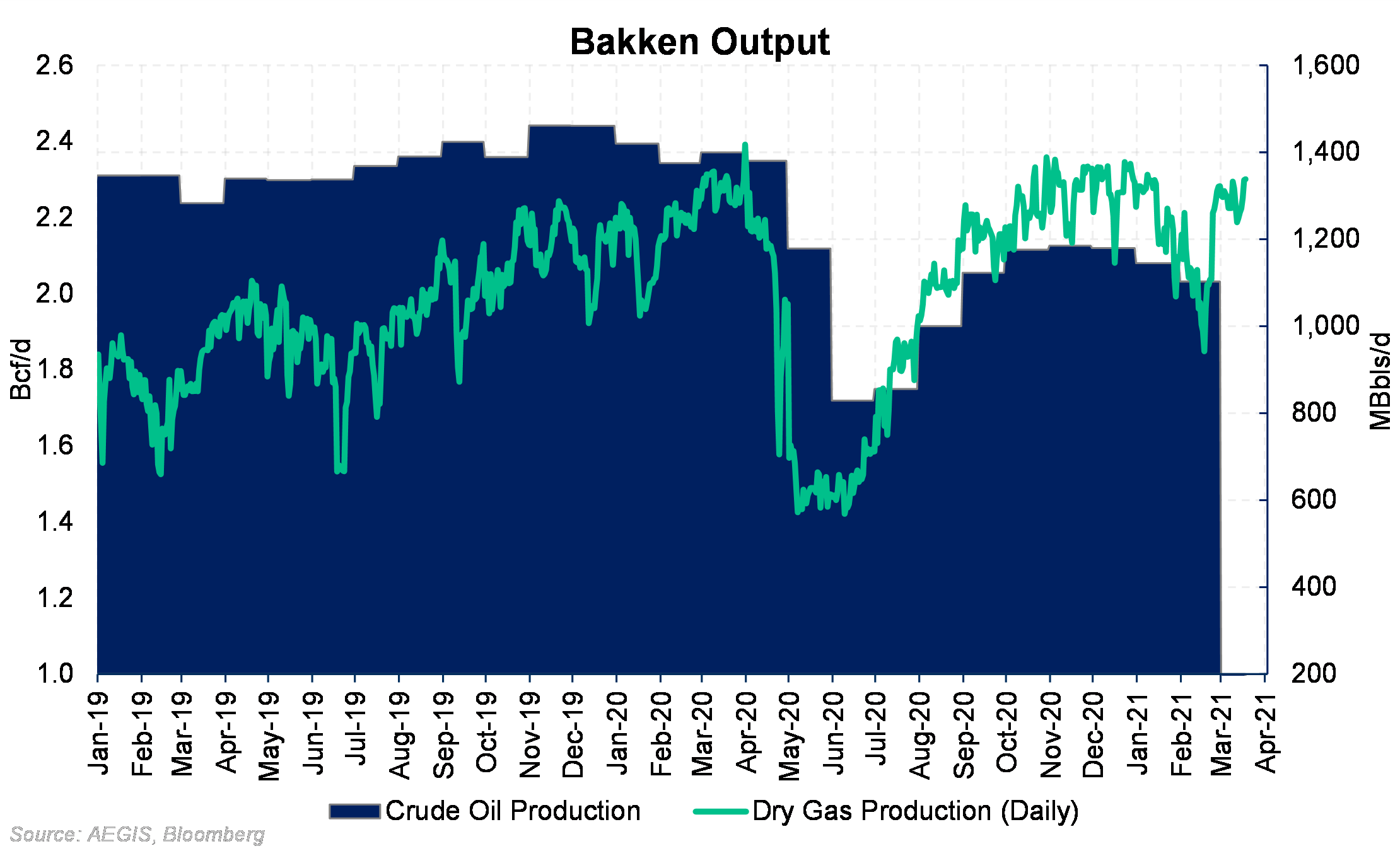

Official crude production numbers in the basin are subject to a delay in reporting and can be opaque. Because most drilling is oil-directed in the Bakken, gas flows can sometimes be used as a proxy for real-time oil production. Dry gas production was hovering near 2.3 Bcf/d before falling to 1.85 Bcf/d in mid-February- its lowest since July 2020. The Largest crude artery out of the Bakken, the Dakota Access Pipeline (DAPL), is facing a possible suspension. A court hearing is scheduled for April 9 that could determine the pipeline's fate. The removal of DAPL would decrease pipeline takeaway capacity by 570 MBbl/d for the Bakken region, redirecting barrels to leftover space on other outbound pipes and more expensive crude-by-rail. The chart below shows that if the court ruling is in favor of the opposition, the Bakken region will lack enough pipeline capacity needed to move its crude.

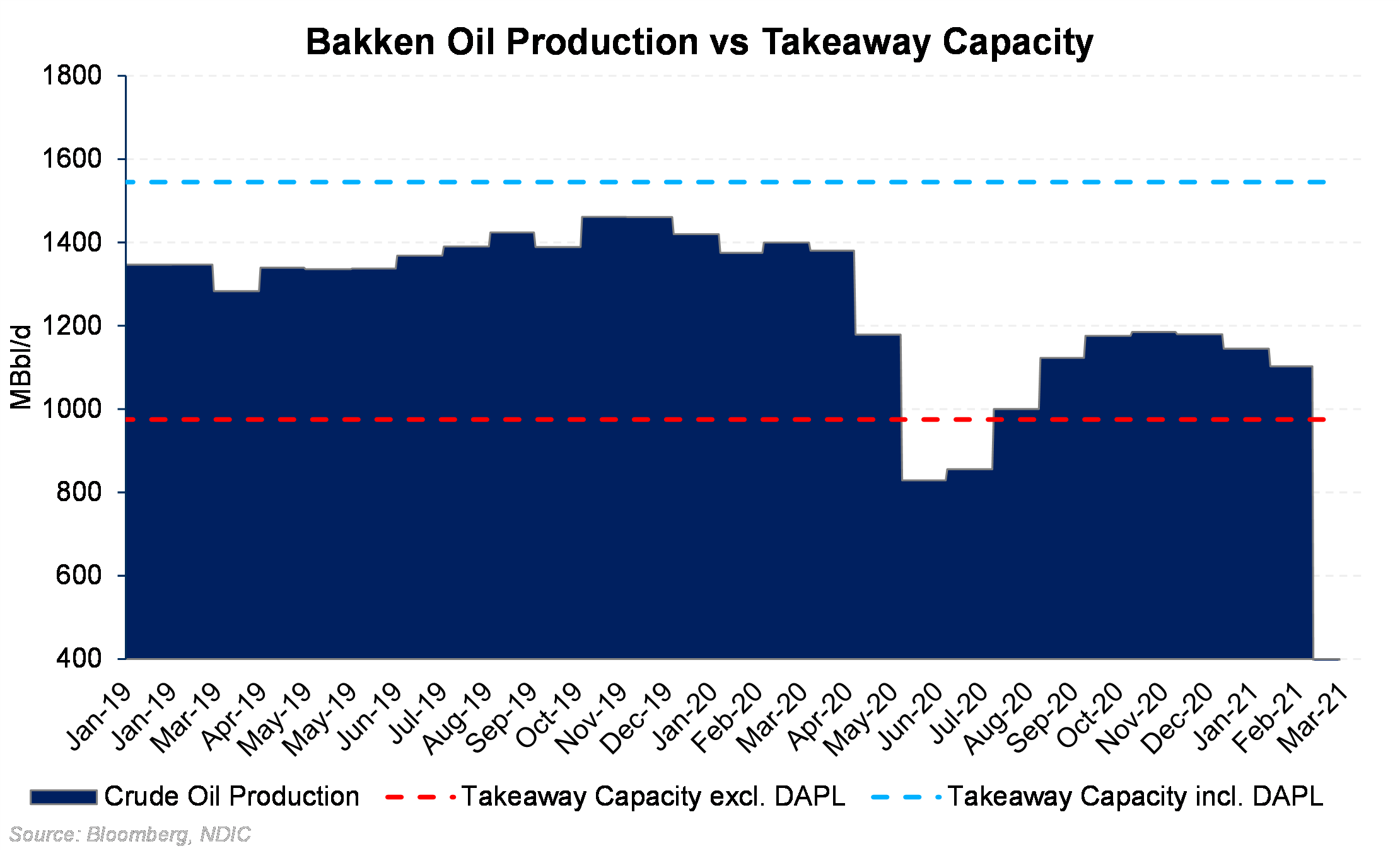

The Largest crude artery out of the Bakken, the Dakota Access Pipeline (DAPL), is facing a possible suspension. A court hearing is scheduled for April 9 that could determine the pipeline's fate. The removal of DAPL would decrease pipeline takeaway capacity by 570 MBbl/d for the Bakken region, redirecting barrels to leftover space on other outbound pipes and more expensive crude-by-rail. The chart below shows that if the court ruling is in favor of the opposition, the Bakken region will lack enough pipeline capacity needed to move its crude. The capacity provided by the DAPL pipeline has helped prices stabilize between $1 - $2 behind WTI, except for brief periods of infrastructure disruptions. In the past, the discount for Bakken crude to WTI at Cushing had widened to $5-$20/Bbl when supply in excess of pipeline takeaway capacity was moved by higher-cost rail. If the DAPL pipeline is ordered to empty, Bakken Clearbrook basis prices could retreat to the cost of crude-by-rail, which could cause Clearbrook to trade -$8/Bbl under WTI by our estimates.

The capacity provided by the DAPL pipeline has helped prices stabilize between $1 - $2 behind WTI, except for brief periods of infrastructure disruptions. In the past, the discount for Bakken crude to WTI at Cushing had widened to $5-$20/Bbl when supply in excess of pipeline takeaway capacity was moved by higher-cost rail. If the DAPL pipeline is ordered to empty, Bakken Clearbrook basis prices could retreat to the cost of crude-by-rail, which could cause Clearbrook to trade -$8/Bbl under WTI by our estimates.