SituationWith long lead times on raw materials and short lead times to fulfill customer orders, a metal extrusion company was consistently at risk of buying high and selling low on aluminum inventories. A structured hedge plan has led to significantly reduced risk on inventories. While metal processors “hope” to pass along commodity price risk to customers, this can be challenging when purchasing commodities at short-term peaks. As commodity prices fall, customers expect their prices to follow. However, in what industry professionals refer to as “metal lag,” the underlying cost of goods is already realized well before the customer order is fulfilled. This mismatch can lead to reduced margins at best and lost customers at worst. This management team was focused on reducing earnings volatility and its underlying exposure to a rapid fall in commodity prices. |  |

SolutionThe company partnered with AEGIS Hedging, a recognized leader in financial hedge advisory and technology, and together they built a comprehensive inventory hedging strategy to minimize the risks associated with metal lag.Working with the company to understand the company’s margin targets, capital structure, and risk tolerances, AEGIS tailored a strategy consisting of bought puts that provided an artificial floor on inventory prices should prices fall. The hedging strategy was matched to expected purchases and sales and structured in a way that permitted ongoing adjustments.AEGIS’ market intelligence and advisory capabilities allowed the company to gain insight into the factors driving commodity pricing, company-specific exposures, and ongoing tracking of its hedge protection - all at a fraction of the cost of building the capabilities in-house. |

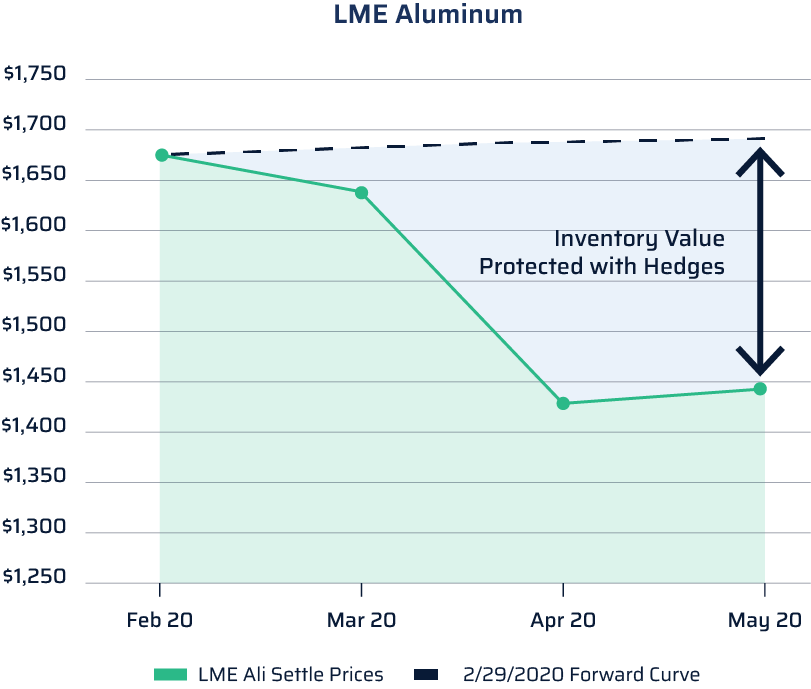

OutcomeWhile nobody could have predicted the onset of the COVID-19 pandemic, the strategy was critical to allowing the company to navigate the impacts. Aluminum prices declined precipitously between March and April 2020. As prices declined, the company recognized significant gains on their inventory hedges, softening the impact of the pandemic and providing financial support that avoided costly inventory liquidations. As prices spiked, the company was able to be back in the market with its inventory intact in a rising price environment. While we hope it is a rare occasion that the world pauses and the economy stands still, the same strategy can be deployed any time near-term commodity shortages are driving seemingly inflated near-term prices. And it can allow all executives to mitigate risk as they sign off on significant inventory purchases. |

"AEGIS has been an incredibly helpful partner in enabling our organization to manage risk. With the uncertainty of the pandemic, Section 232 tariffs, and the numerous other landmines we faced, AEGIS was instrumental in making sure that we were properly hedged and informed. The AEGIS Research is presented in a succinct manner that ensures everyone on our team is aware of what is happening in the market.” |

Leadership Team | Metal Extruder