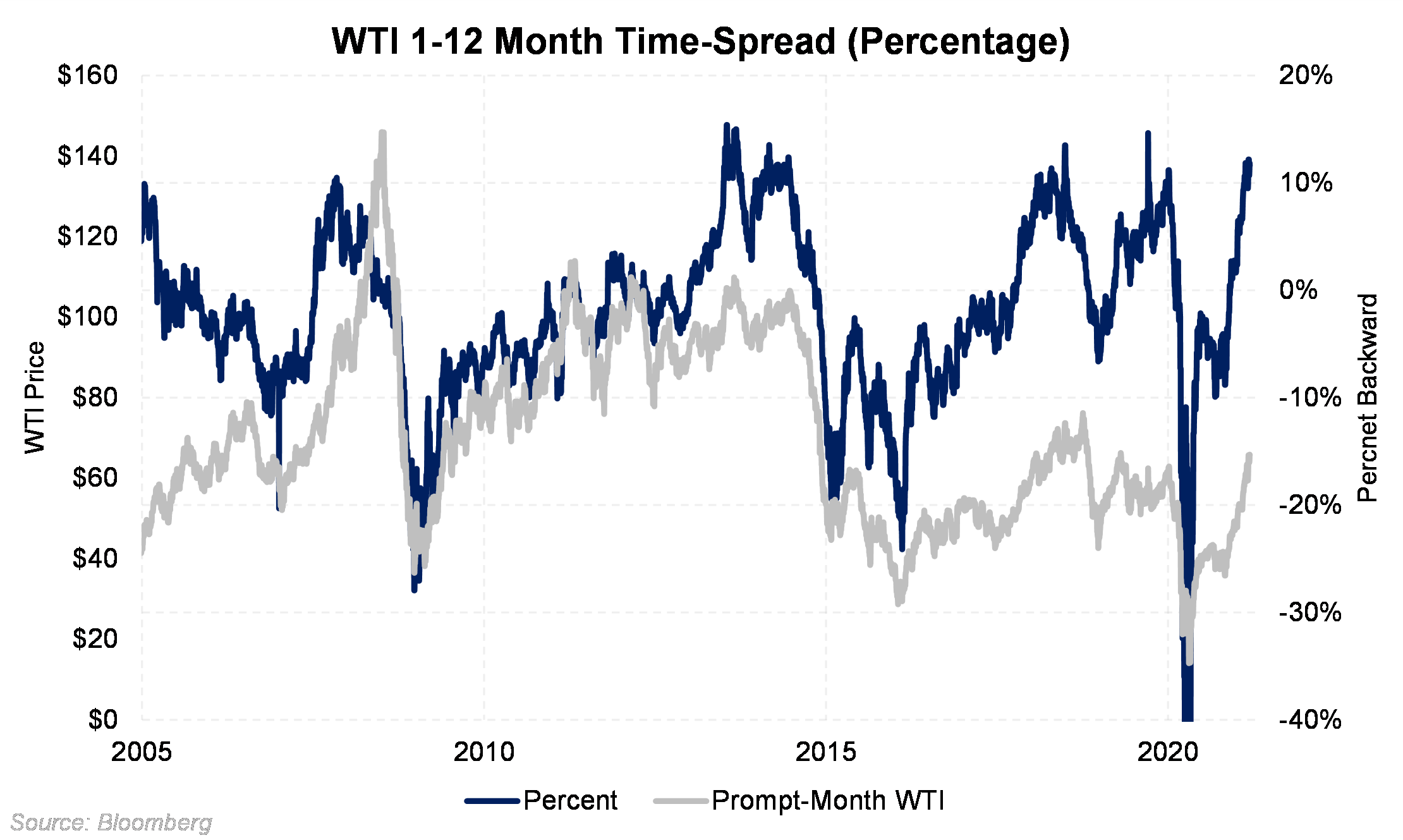

The near-term WTI contract at $65.80/Bbl is $6.8/Bbl, or 11%, higher than WTI one year from now.

A backwardated curve can mean that oil is in higher demand today than what is expected in the future. In a backwardated, or downward sloping curve, crude oil consumers are willing to pay a higher price in the present than in the future.

Higher prices in the front of the curve encourage oil traders to sell barrels from storage today, decreasing global inventories.

Despite an unprecedented decline in global oil demand from lockdowns in 2020, historic OPEC+ cuts have brought the market back into a supply-demand deficit. It is estimated that the market is now tight daily by 1.5-2 MMBbl/d according to OPEC+, which is corroborated by the strong price rally and the amount of backwardation in the market.

Will the rally in prices continue? Its possible. Global demand is still in the midst of its recovery to pre-pandemic levels. However, OPEC+ supply is still the number one factor influencing prices. OPEC+ manages the oil market on a month-to-month basis now. It is possible that in the future, the group unwinds cuts or relaxes on quotas in-order to cool down the market.

The large percentage of backwardation in the oil market doesn't mean crude will fall, but we do recommend being prudent on hedging considering this year's run-up in price.