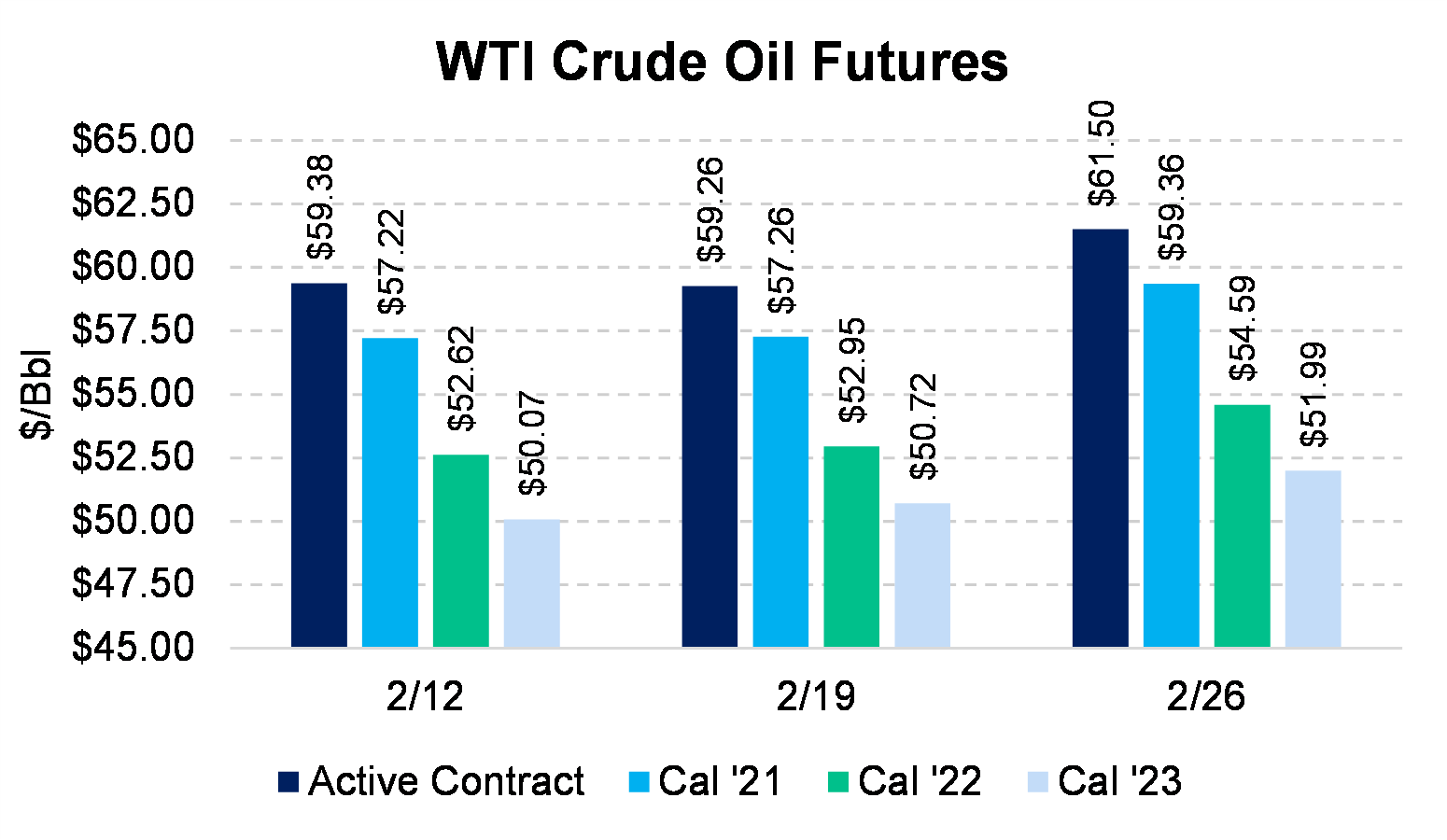

WTI has rallied over 30% since January 1 to $62/Bbl as of February 26 — the largest percentage increase to start a year in at least the past 30 years. You may hold a continued bullish view from current levels, but we recommend taking a hard look at de-risking your portfolio as Bal 2021 trades at $60/Bbl and Cal 2022 at just above $55/Bbl.

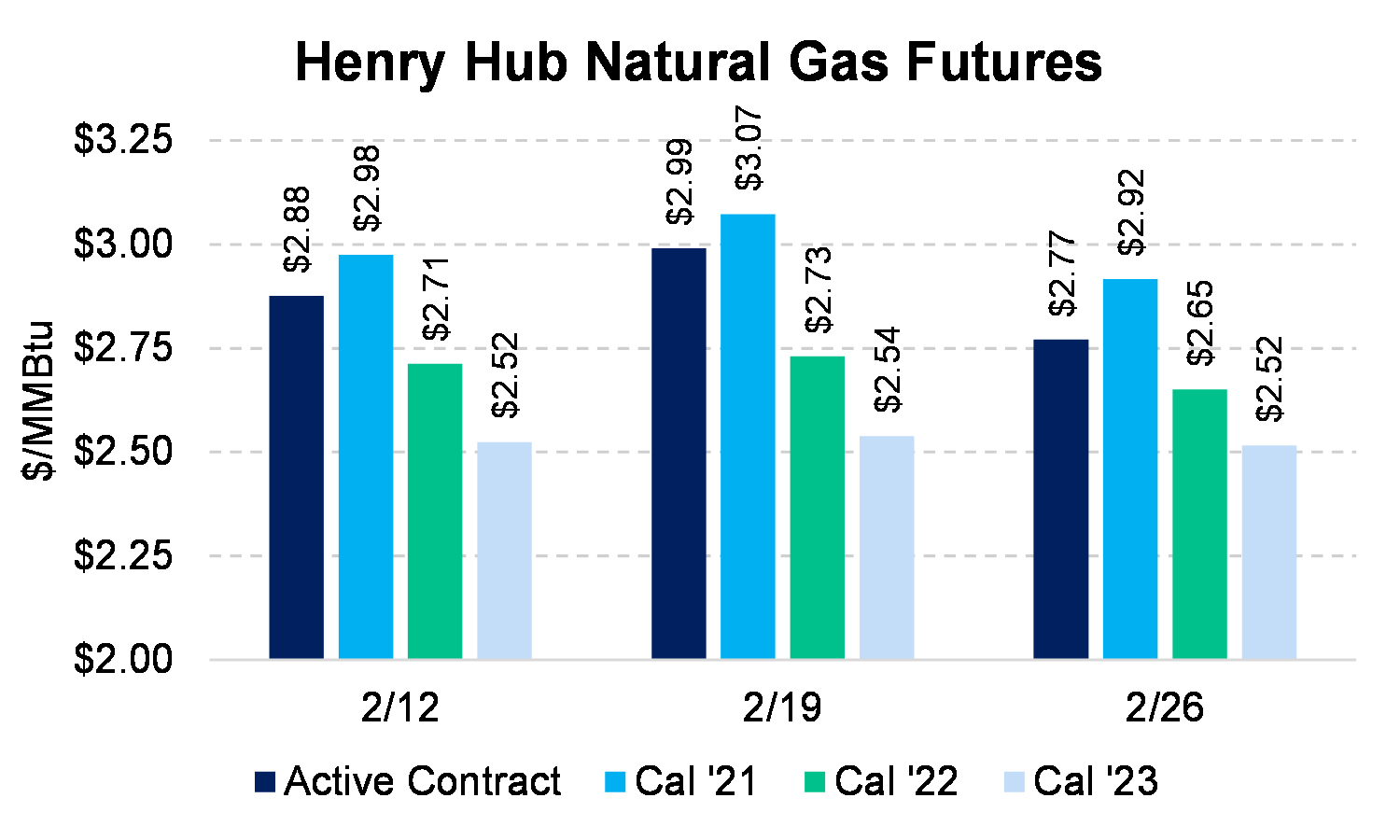

Usually, a costless collar is used to allow for more upside participation. However, puts options are relatively more expensive than call options — the opposite of what you want as a producer. The current put-call skew may push producers toward using swaps instead. Swaps may be the better option right now, given the lopsidedness in collars. A Cal 2022 costless collar was $50 X $58 on Friday, when the reference swap was $55.13. This structure would be giving up $5 to the downside for $3 of upside. If your portfolio is already swap-heavy, but you would like to add more upside exposure, then collars may be beneficial to facilitate a diversified portfolio.