|

|

OPEC+ says it wants to match demand growth, so more production is coming. But they do not have a good track record. Mitigate short-term risk with swaps.

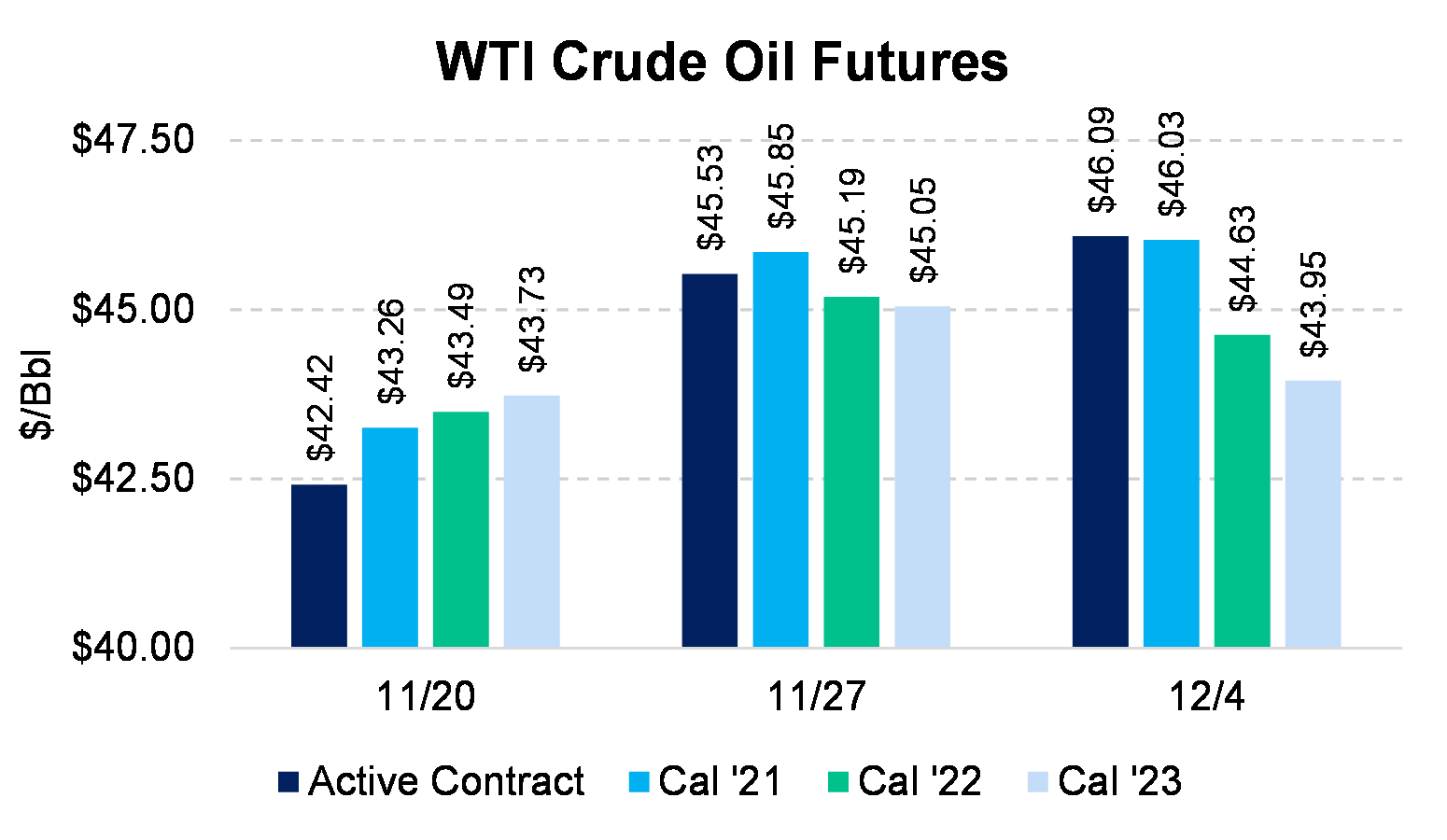

OPEC+ met this week, after delaying by two days their initial schedule. The market expected the cartel to continue with production cuts and postpone production increases that had been planned for January. OPEC+ slightly disappointed, with a 0.5 MMBbl/d announced increase for January, but the market shrugged it off. Good enough.

The news does not change our point of view. We still see 1H2021 as a fragile balance between demand recovery and OPEC+ supply schedules. Multiple vaccines seem to be readied for deployment next year. Saudi Arabia has said it would advise OPEC+ to increase production "drip by drip" as needed. But, what if they get it wrong (like they did with Iran sanctions, the March price war, etc.)? OPEC+ cannot respond that quickly, as they have shown. A month-to-month decision does not work, in our view, when multiple sovereign participants must cooperate.

And, regarding demand, the recovery is not certain. Vaccines will likely result in changes in travel and other energy-consumption behavior, but the effect should not be expected immediately.

Eventually, demand should stabilize, and we still think 2022 is the year where prices realize higher to encourage non-OPEC production growth.

So, for short-term hedges, keep looking at swaps as your first choice, especially as prices have risen. And, many of you are; AEGIS trade volumes are up a lot in November and December.

In 2022, some variation of collars is the best choice, with the individual type or strikes set by your unique situation. If you need to consider vanilla collars or three-way collars, contact the AEGIS trading desk.

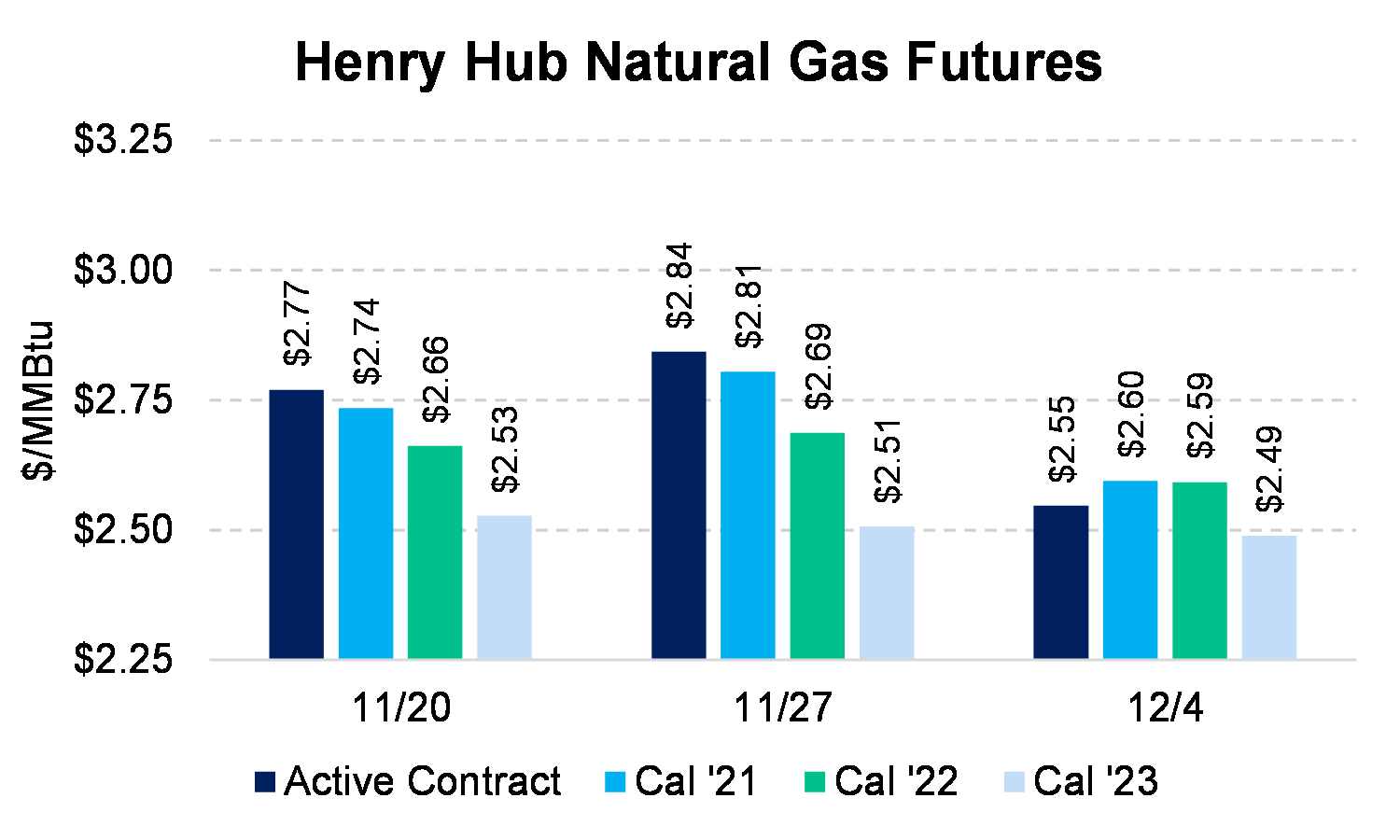

A warm start to winter limits your upside, so producers should consider swaps if they have need to add winter hedges. For Summer 2021 and beyond, prices could materialize much higher than the curve.

Through mid-morning Friday, the natural gas curve had given up 25c on the week for the remainder of winter, and 16c for summer. It was an improvement over the abysmal Thursday trading day, which sent the January contract down to a $2.51 close, from $2.84 just a week ago.

The curve twisted in some strange ways. The Jan-Mar strip (1Q2021) settled two cents below the summer strip. Just three days into December, and the market already looks to have given up hope on the remainder of winter.

The bearish sentiment spilled over into next winter's strip. In fact, the consistent selling through the March 2022 contract implied that traders with gas length were selling it throughout the curve. More thoughts on Thursday's drop can be found here.

Looking forward, we still believe 2021 will be undersupplied, but we want to issue a warning for the remainder of winter. As we noted in the above-linked post, time is running out on winter. As weather has been mild, there has been slower withdrawals from storage than there could have been. This leaves more supply for peak- and late-winter days. Meanwhile, there are fewer days left in winter, and this means less probability of sustained periods of strong demand.

Therefore, even though we see upside to price, we recognize the chances for it to happen are diminished. For the rest of winter, if you have hedges to add, look to swaps first. Collars may look attractive, but if there is equal chance of prices moving higher or lower, then a low floor may not be worth risking for limited upside.

But here's the good news: AEGIS gas clients are very well hedged. Many took advantage of prices when they were high (remember those $2.90 X $4.00 collars?). If you're wondering how you're positioned, the AEGIS Platform is the place to check your portfolio and see how well you are hedged versus your peers.

Could the gas forward curve, in its weakened state, reflect reality? In our view, the curve is pricing in a combination of these possibilities: