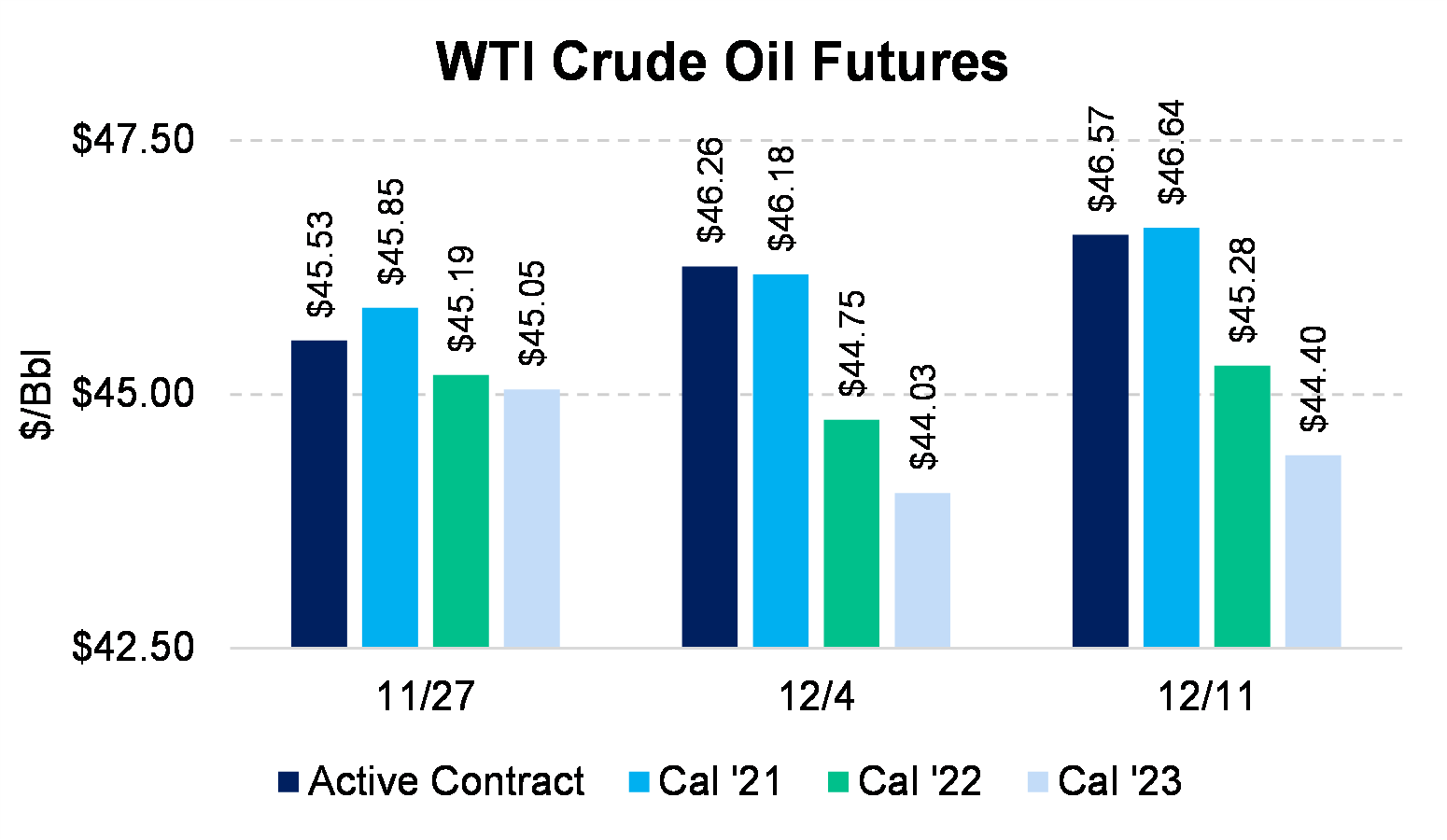

WTI ended up where it started this week, barely changed at $46.57/Bbl, from last Friday's price of $46.26. The first two years of the curve kept its flat shape, with a slight discount in Cal '22 at $45.20.

Six months ago, we know many of our clients were hoping for mid-$40s prices. Now is the time to act if those prices meet your budgets. Selling into price strength usually works out.

Yet, we understand that $46 oil means very different things for different clients. For some, the net margins are thin, while others could tolerate some price correction if WTI were to slip back toward $40.

For most clients, especially those who are underhedged for 2021, we would recommend swaps to convert your variable-priced oil sales to fixed-price. This recommendation is not only reflective of our market-price outlook; costless collars right now require an oil producer to give away more upside than may be wise. For example, a 2H2021 priced during the day on Friday was approximately $40 X $50 (that is, floor X ceiling) while the underlying price was around $46. There is an embedded "penalty" or "fee" of around $2 because of skew in options prices, where puts are relatively dearer than analogous call options.