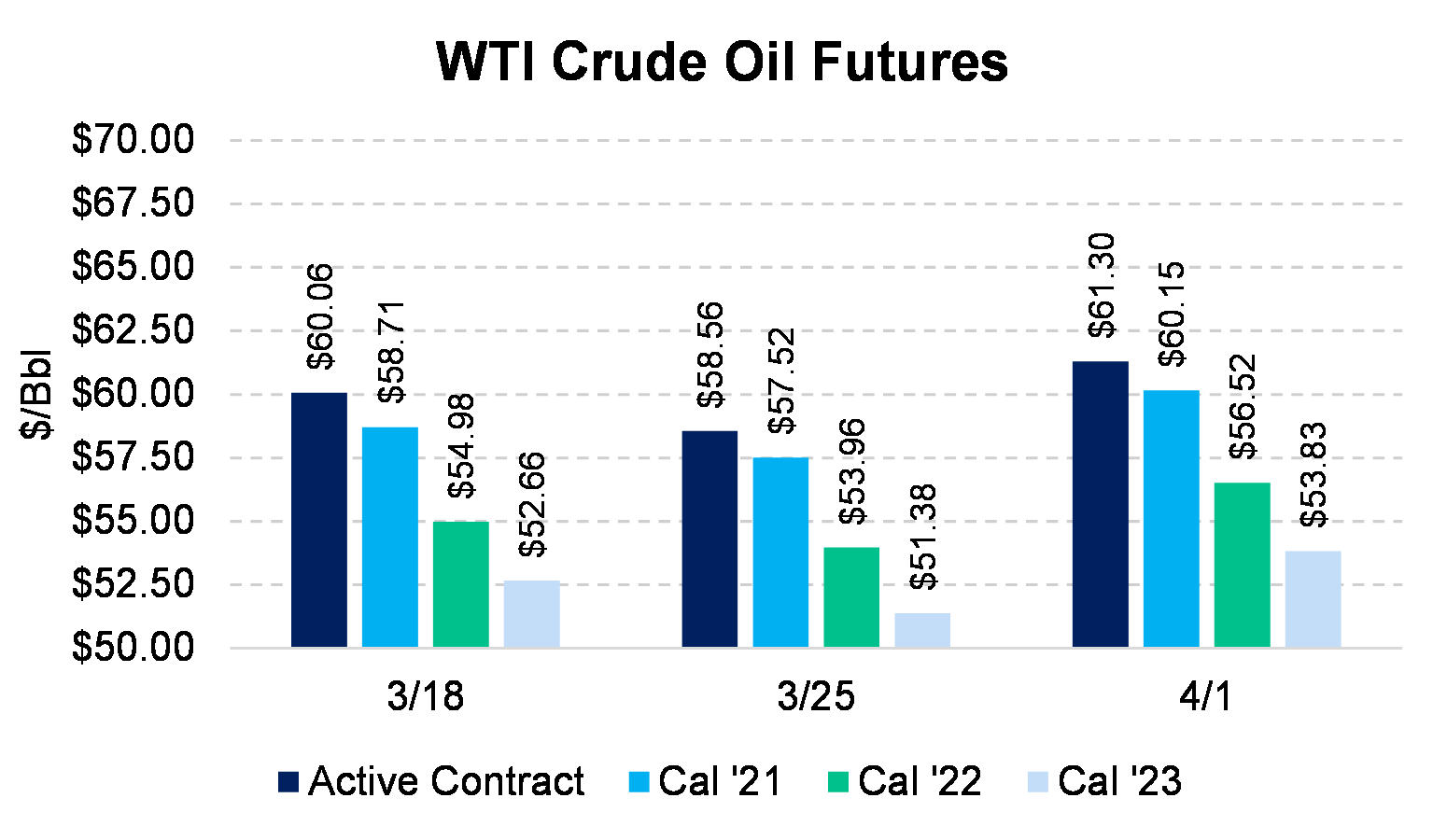

West Texas Intermediate finished higher week-over-week despite OPEC+ deciding to gradually increase output over three months. All eyes were on OPEC and its allies' April 1 meeting during the short Easter holiday week. Many analysts were expecting OPEC+ to keep oil output quotas steady. However, according to the WSJ, the cartel will raise its production by 350 MMBbl/d in both May and June and then increase by 450 in July. Saudi Arabia will also roll back its extra, 1 MMBbl/d compensatory cuts evenly over the same period.

Earlier in the week, the OPEC Joint Technical Committee (JTC) showed that OECD oil inventories would drop down to the five-year average by the end of June — even with increases in supply starting in May. If their analysis is correct, then the global oil market is undersupplied and eventually needs more barrels to meet demand. OPEC+ is managing the oil market closely, and cooperation and compliance between the group are strong.

According to IHS Markit, petroleum product demand is expected to rise by 3 MMBbl/d over the next three months, making the planned OPEC+ output increases conservative. Following the meeting's conclusion, we understand that OPEC+ production is rising; however, the demand recovery is uncertain.

AEGIS recommends swap structures for most client portfolios if current prices are palatable. Swaps are better for increasing books' average weighted price. Option structures could be useful if the portfolio already contains many swaps or if capturing more upside is the goal.