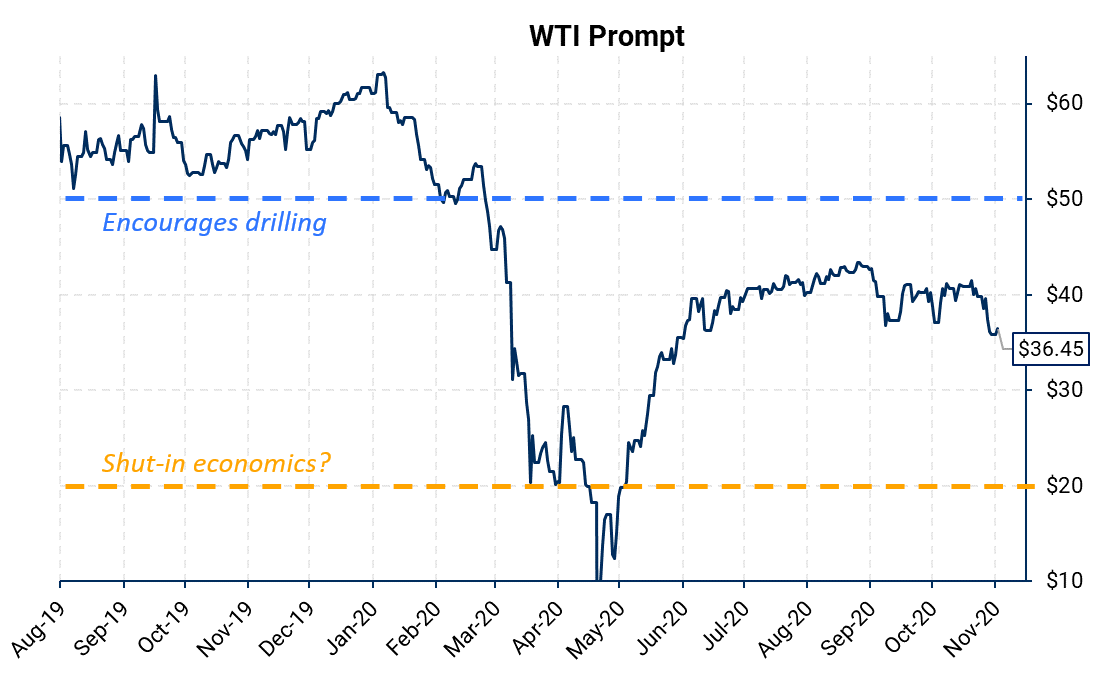

WTI prompt-month oil dipped below $34/Bbl on Sunday evening, November 1. Price recovered in the morning, but this was a warning: be certain your hedges are protecting you in advance, because prices can collapse at a time when you are powerless to do anything about it.

The risk is not over for oil. In the next two months, flu season may worsen the COVID outbreak, and therefore, the oil-demand outlook. OPEC meets in December to decide whether production curtailments will continue in 1Q2022. Libya might produce more in 1Q than anyone had ever expected.

| How much worse could oil get? In the near-term, oil prices are in a no-man's land, where neither higher nor lower prices change the supply-demand balance materially. Early 2020 history taught us that supply is slow to respond to low price, and mid-$20s could be necessary before shut-ins occur.

This does not require locking-in a loss. We understand many E&Ps have financial difficulty with WTI in the mid- to upper-$30s. While AEGIS does expect prices to get better in 2022, in the near-term, the primary roles of risk management and an effective hedge program is to get through this season in the markets. |

We propose a solution: For the next year of the oil forward curve, execute hedges quickly on those days when oil prices fluctuate and crest higher than your financial targets require. To do this, you will need to do some homework:

It could get worse before it gets better. In the last six months, many E&Ps have neglected hedging. Many are behind in building their protection for 2021 and 2022, and at a bad time. Protect yourself now, but remember: The lower the market goes in the months to come, the higher we may go in the years to come.

Questions or comments, please contact us at view@aegis-energy.com