|

“There suddenly seems to be a lot more copper around than was being projected by LME stocks and spreads just a month ago. Reuters, 3/22/2021

Source article (opens in new tab): Column: Funds take the money and run as copper rally stalls |

Article Summary

|

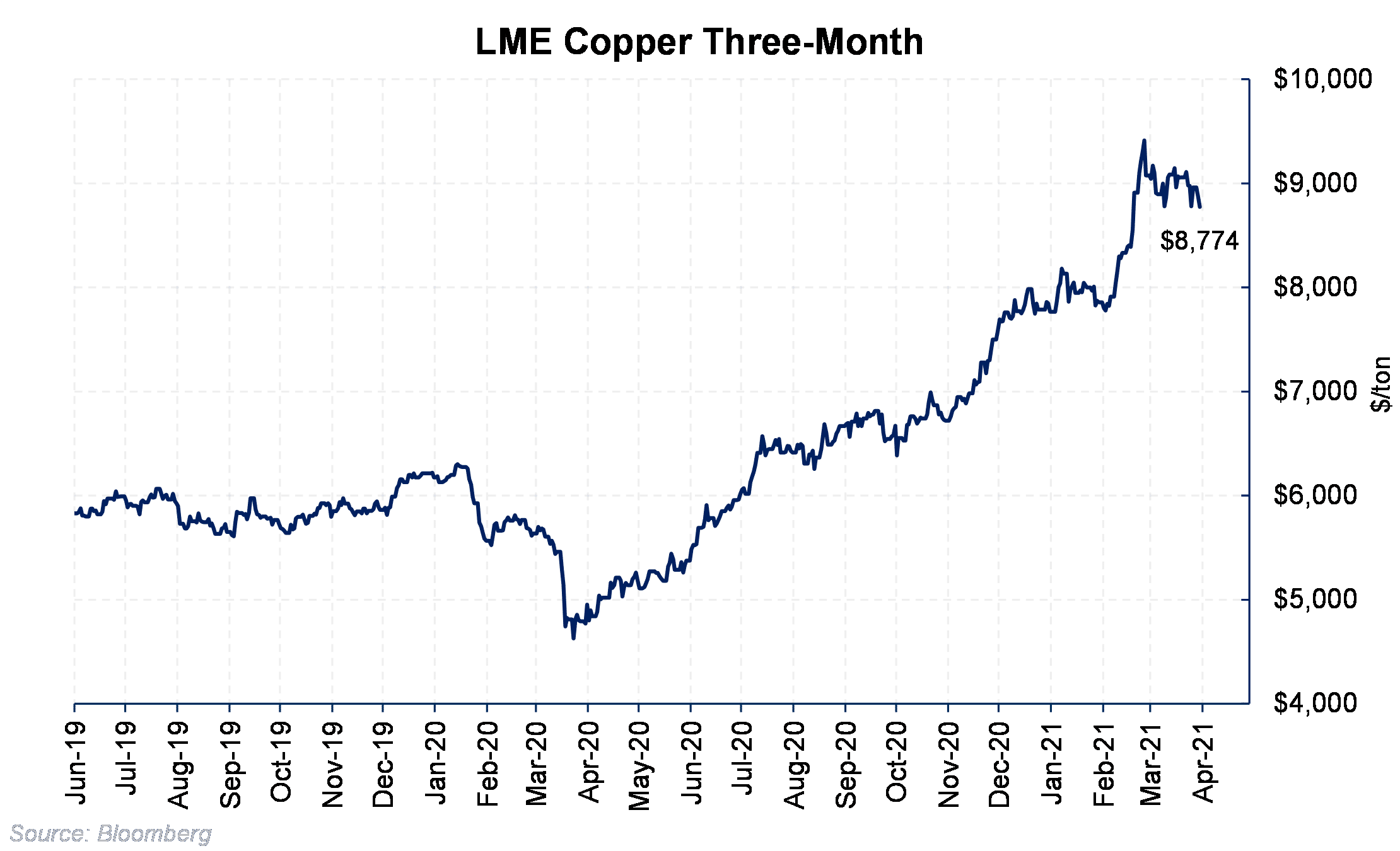

Copper has been on a tear since March 2020. LME copper has risen from just below $5k per metric ton to about $9k since last March's low. The profit-taking by various momentum-driven funds is to be expected when prices rally over 100%.

Strong Chinese demand and supply issues caused by the pandemic have been the catalysts for the rally. China accounts for nearly half of the world's copper demand, but COVID has moved other nations into the spotlight as strong consumers of copper. Kostas Binatas at trading house Trafigura said, "What COVID has done is it has made the rest of the world a major factor in consumption growth, compared to the past, when copper was all about China." There are also concerns about shadowy copper stockpiles showing up in the market. Still, according to Trafigura, the pandemic has taken a heavy toll on the supply of scrap and mined copper.

A green revolution is being touted as creating long-term demand for copper. Some analysts have called for a "supercycle" in commodity markets. The move to greener technologies over the next decade should bolster the outlook for many industrial metals.