| In the last hours of his office, former president Donald Trump suspended the Section 232 tariffs against the United Arab Emirates (U.A.E.), a supplier of aluminum from the Middle East. Instead of a blanket 10% tariff on imports, a quota system is now established.

Bloomberg reported that the U.S. Federal Register on Sunday described the import quotas at:

|

According to Bloomberg, there has yet to be any indication whether the Biden administration would adjust the quotas or stance on the Section 232 tariffs.

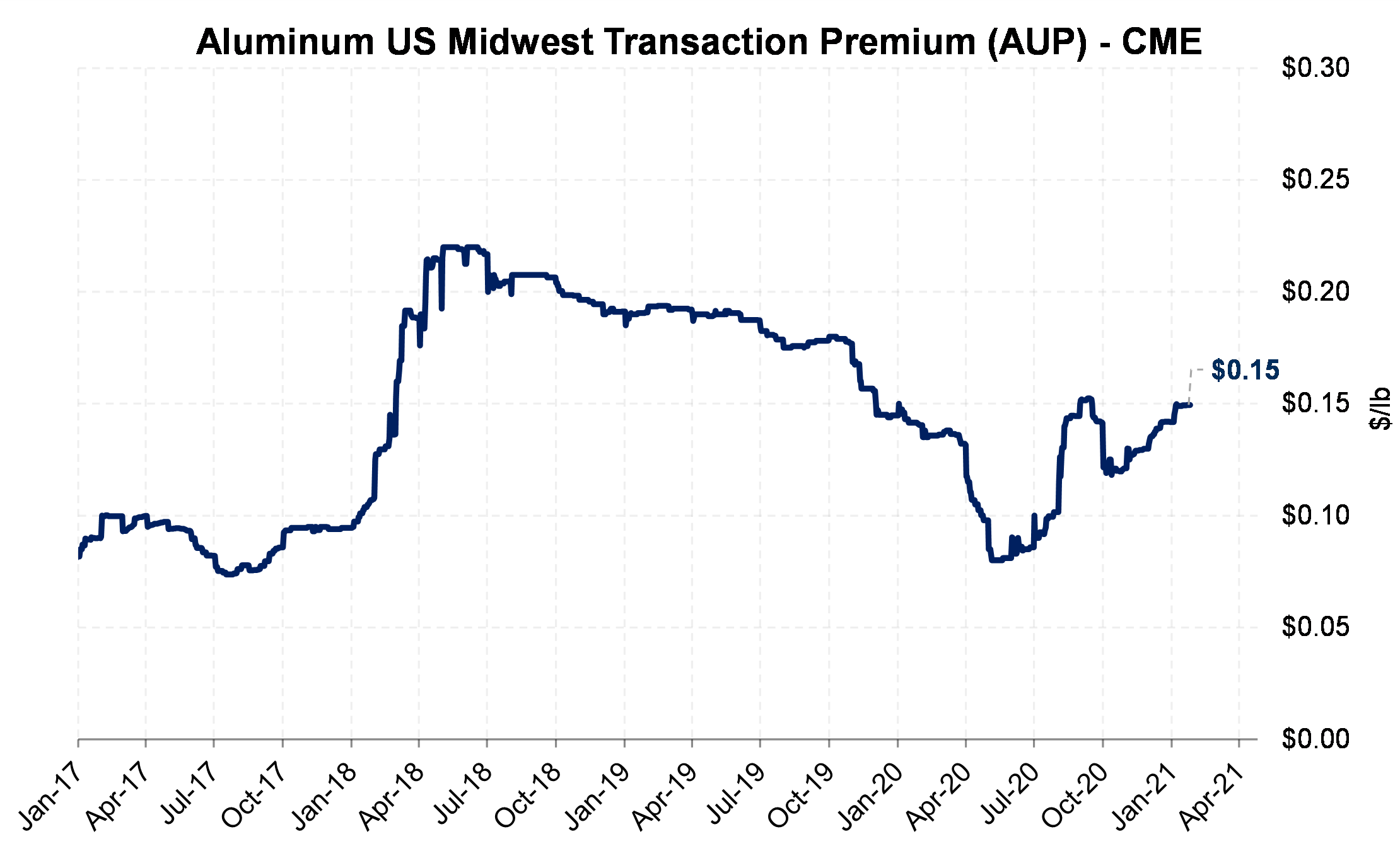

AEGIS notes the end of tariffs effectively lowers the delivered cost of international aluminum to the U.S. This increased supply (at lower cost) can pressure the aluminum Midwest Premium lower.

However, the new import quotas offset some of the bearish effect. These import limits have a governing, bullish effect that can offset the bearish forces. In this case, the announced quotas seem to be generous, restricting the U.A.E. imports by a small amount compared to recent history.

There is a psychological effect, too. As we pointed out in the recent weekly AEGIS Metals Dashboard, uncertainty in the future of tariffs can make consumers hesitant to buy, keeping the forward curve lower than it would otherwise be. The dashboard is available here.Questions or comments are welcome at metals@aegis-hedging.com.