Our view on crude oil prices is neutral for the next 12-14 months (Clients: this is shown visually in our Crude Oil Factor Matrix). There are multiple factors that bring us to this conclusion.

For demand, some of the major institutional energy analysts like the Energy Information Agency (EIA) and OPEC's research arm, forecast demand to stay below 100 MMBbl/d at least through 2021. This means demand would not reach pre-Covid levels until early 2022, with slow recovery in aviation fuel demand as one of the main culprits. On a United Airlines conference call Thursday, CEO Scott Kirby said, "We've got 12-15 months of pain, sacrifice and difficulty ahead."

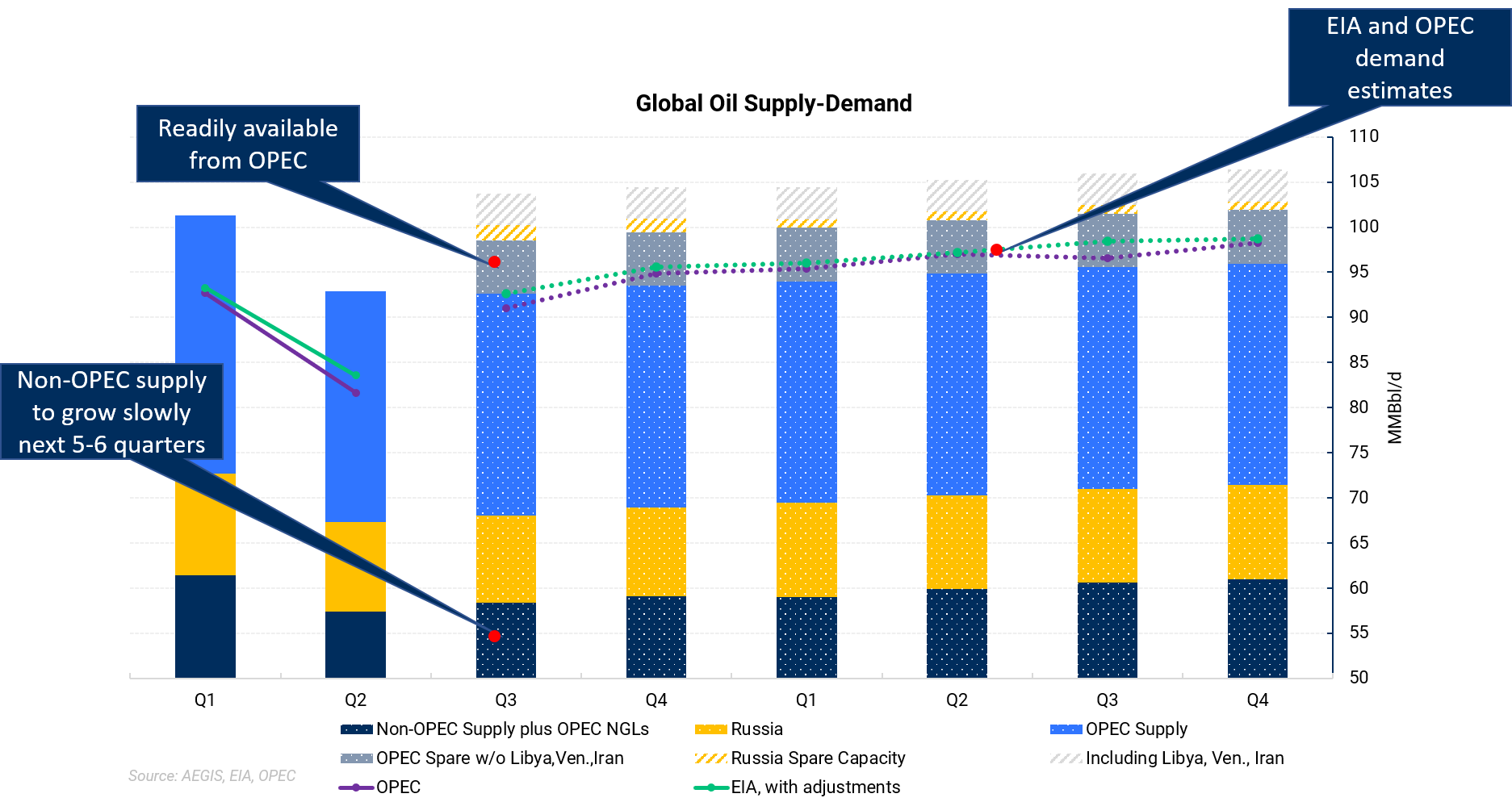

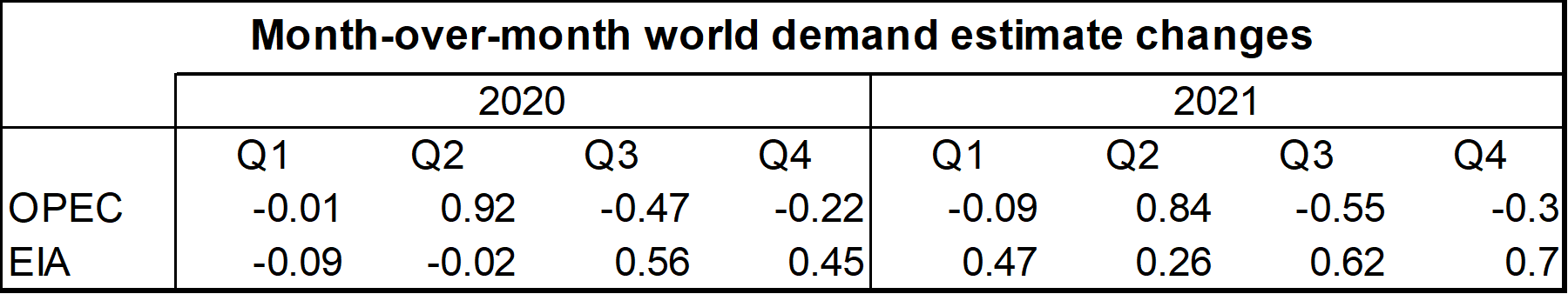

The OPEC and EIA forecasts for demand are represented in the chart below. The table shows demand estimate changes from September to October.

It is highly uncertain when demand may return to pre-Covid levels. We have to consider what type of impact a vaccine may have or if people's behavior will be changed even with good therapeutics or a working vaccine over the next few years.

Supply on the other hand is a little better understood. The chart above shows total estimated global oil output represented by adding the dark blue, medium blue, and gold columns. The solid gray area near the top represents OPEC spare capacity minus countries such as Libya, Iran, and Venezuela. Our read on OPEC is that their policy is to try and match more supply with increasing levels of demand. If this is the case, OPEC holds plenty of oil readily available to releases into the market as the gray area shown in the chart surpasses increases in forecasted demand through 2021. Remember, OPEC only cut oil by a historic amount in Q2 2020 because oil prices crashed. There wasn't anyone to physically purchase some of their oil due to lockdowns. From OPEC's own rhetoric, it's fair to say that if they can produce more, they will, as long as they believe the market can absorb it.

Recent output increases in Libya, who is exempt from collaborative OPEC cuts, have made OPEC's calculus more difficult. The cartel still plans on easing production cuts starting in January, but this could change depending on how much Libya increases and where demand evolves until then.

Non-OPEC supply is expected to be subdued for at least the next year.

Watch OPEC closely on how they manage their spare capacity. While there are some outcomes that could produce higher prices, the chart above should worry most bulls who are hoping for materially higher prices to arrive soon.