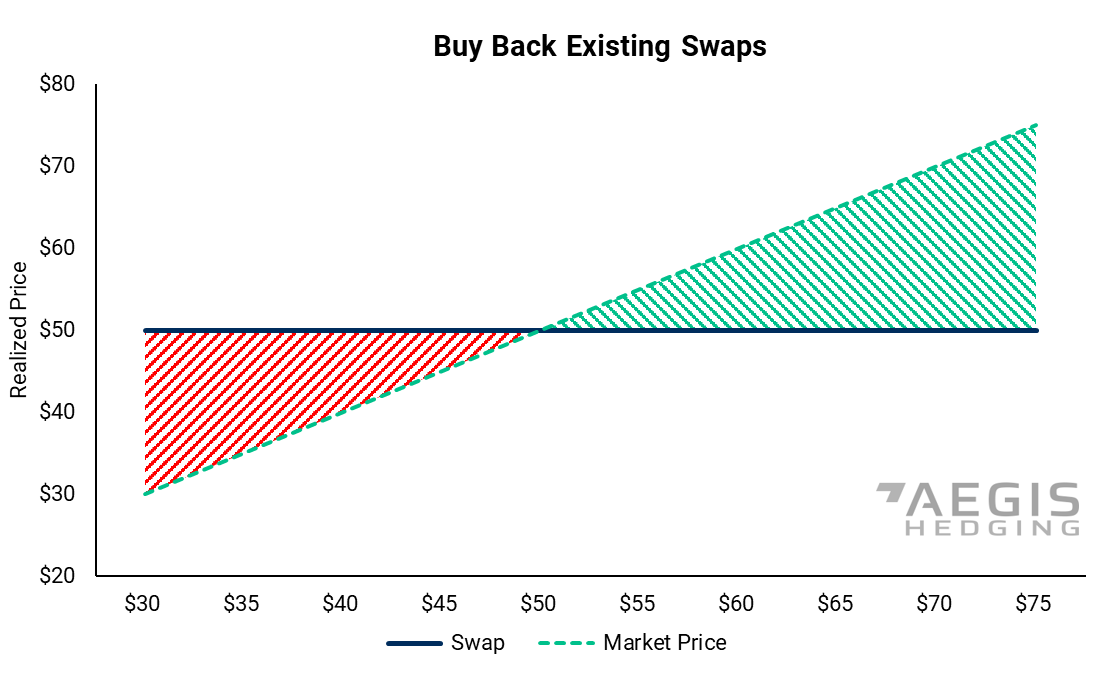

In the chart below, the red shaded portion represents the incremental downside risk the trade provides, while the green represents the upside participation gained. Benefit — Upside exposure increases on a portfolio level, even if existing swaps remain on the books. You get to participate in a rally for the bought barrels.

Benefit — Upside exposure increases on a portfolio level, even if existing swaps remain on the books. You get to participate in a rally for the bought barrels.

Danger - Zero downside protection remains on the volumes bought back. Downside exposure is increased, and some lending agreements may not allow this strategy if it brings a portfolio out of compliance.

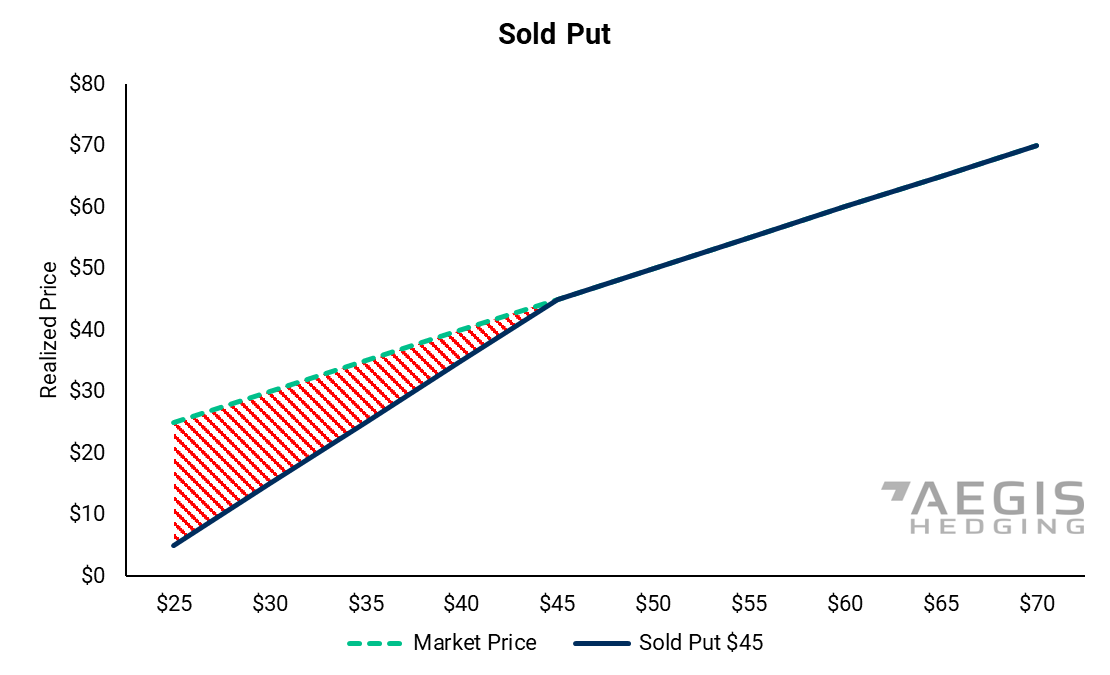

In the chart below, the red shaded portion represents the downside protection lost by utilizing this tactic. Typically, we would not recommend utilizing trades that remove downside protection. However, the proceeds from selling puts could be used to adjust a hedge, perhaps to uplift a floor or cap.  Benefit — Small premium earned, which could be divested into paying for structures that would allow upside participation.

Benefit — Small premium earned, which could be divested into paying for structures that would allow upside participation.

Danger — It doubles your risk if prices were to fall below your strike.

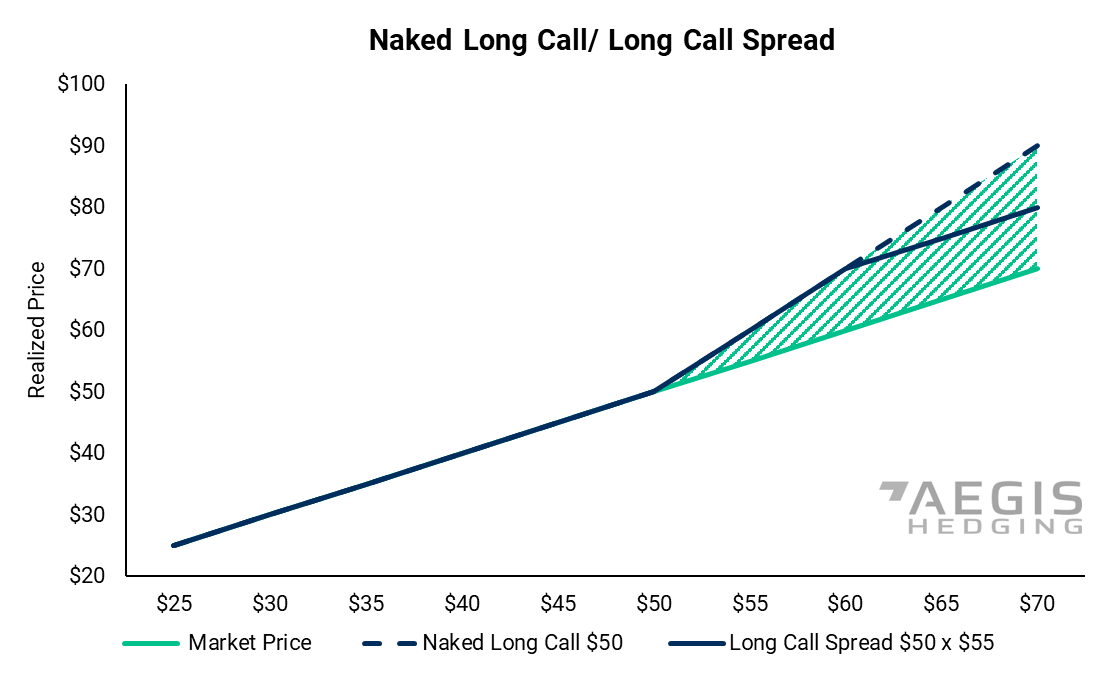

In the chart below, the green shaded portion represents the upside exposure gained by utilizing this structure. The long call helps increase upside participation but can be expensive on its own. If a call is sold above the bought call, it would help offset the premium but limits the upside participation to the market price minus the spread between the legs of the call spread.  Benefit — Losses are limited to the premium paid and tailored to your point of view on prices.

Benefit — Losses are limited to the premium paid and tailored to your point of view on prices.

Danger — Expensive; Can be interpreted as speculative.

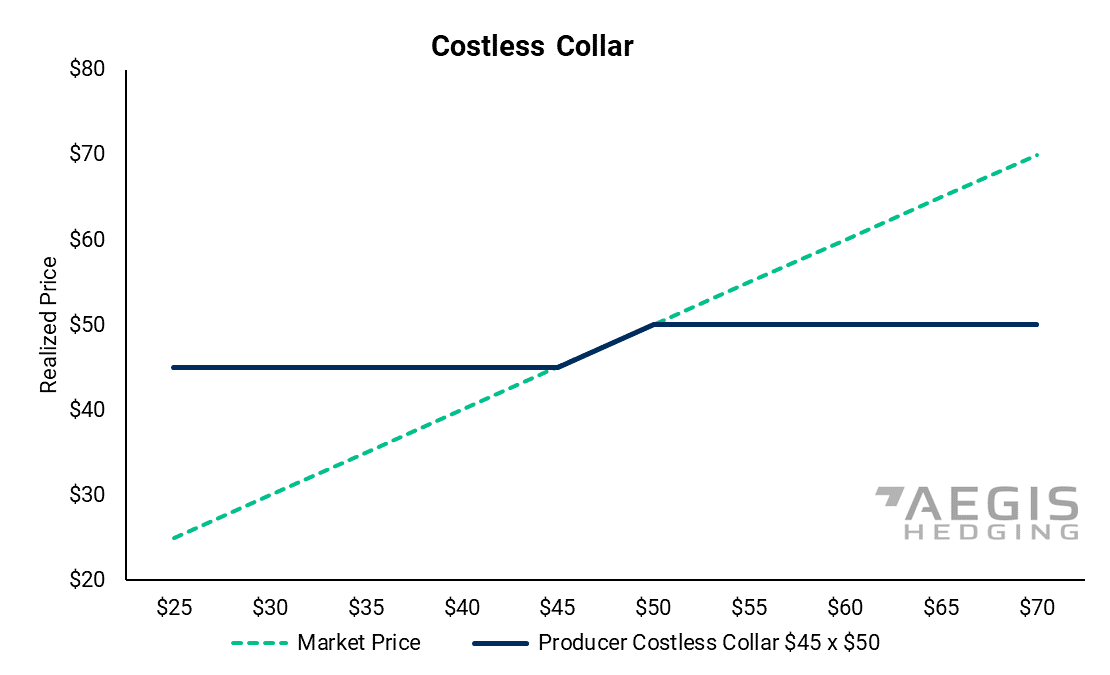

The chart shows the mechanics of a costless collar and how a producer could take advantage of price fluctuation in between the "floor" and "cap". Aside from swaps, a costless collar is one of the most commonly used hedging strategies. However, if you believe prices will rise there are a few ways to tailor the structure to achieve your hedging goals such as paying a small premium for an enhanced collar.  Benefit — Good, straightforward protection; Can gain more upside by purchasing a higher cap (enhanced) or lowering the floor.

Benefit — Good, straightforward protection; Can gain more upside by purchasing a higher cap (enhanced) or lowering the floor.

Danger — Very little if the floor is set appropriately.

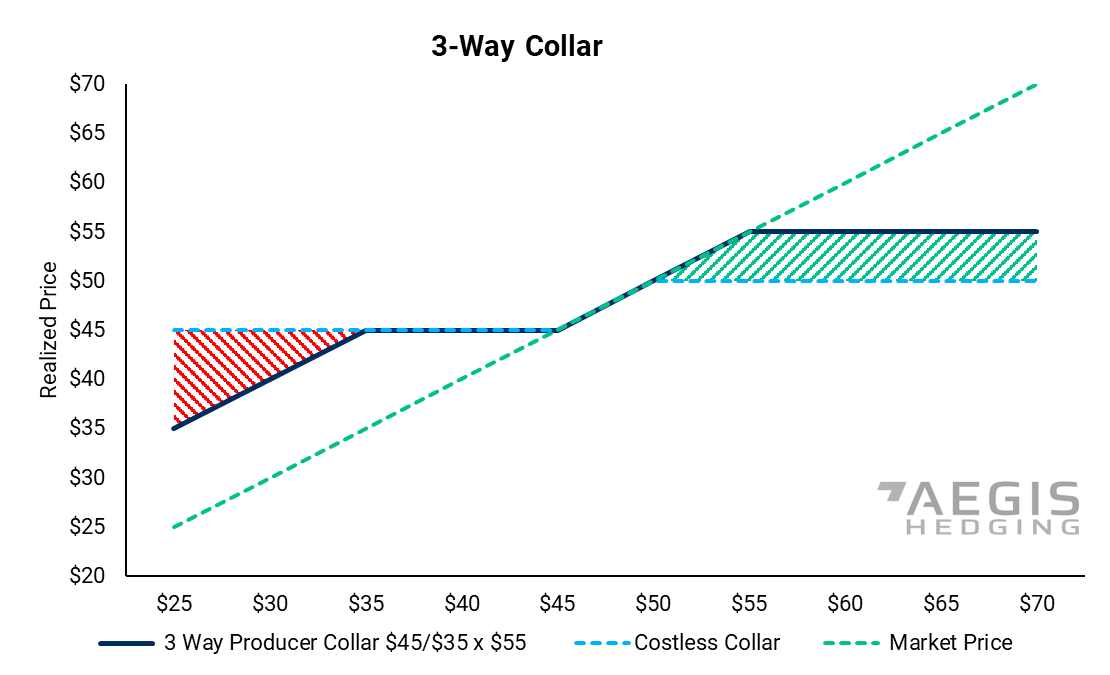

The chart shows the upside gained and downside protection lost by this structure, as compared to an ordinary (two-way) collar. The 3-way collar allows you to gain upside without having to pay a premium but technically your downside protection will be limited to the spread between the put options.  Benefit — Costless; increases exposure to higher prices than does a collar.

Benefit — Costless; increases exposure to higher prices than does a collar.

Danger — Downside protection is lowered.

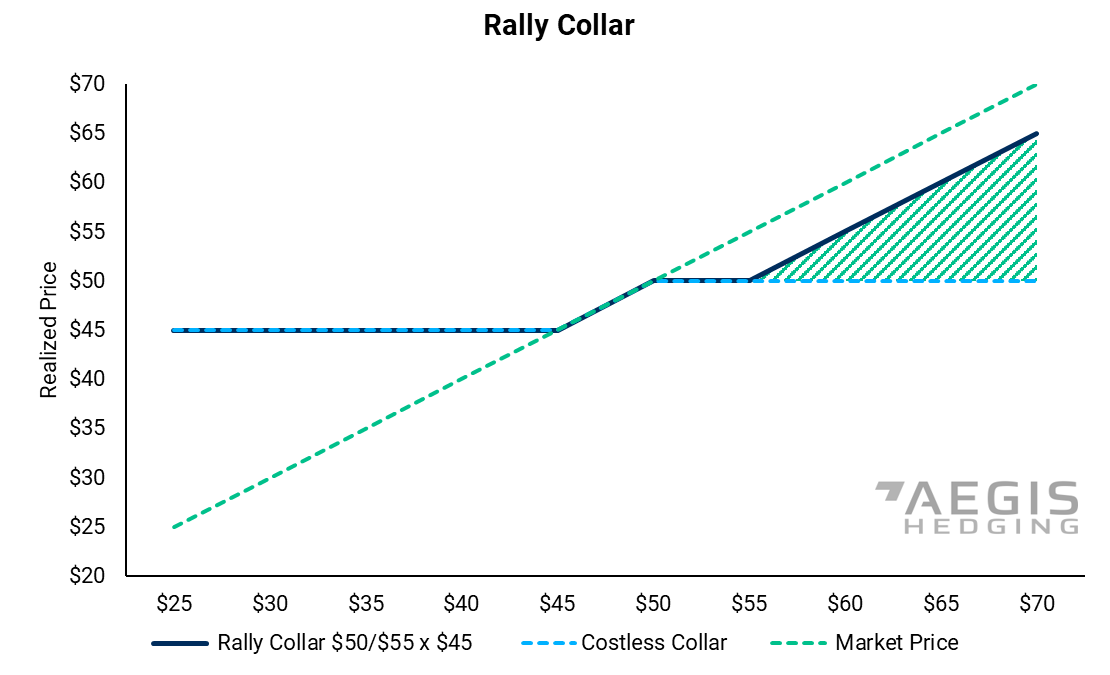

The chart shows the upside gained from a rally collar, though at a cost of the premium of the call option. A rally collar is an attractive, albeit expensive strategy that allows producers greater upside participation. Benefit — Maintains downside protection with a floor and gains exposure if prices move much higher. It can be costless.

Benefit — Maintains downside protection with a floor and gains exposure if prices move much higher. It can be costless.

Danger — Net cost is higher than a vanilla collar.