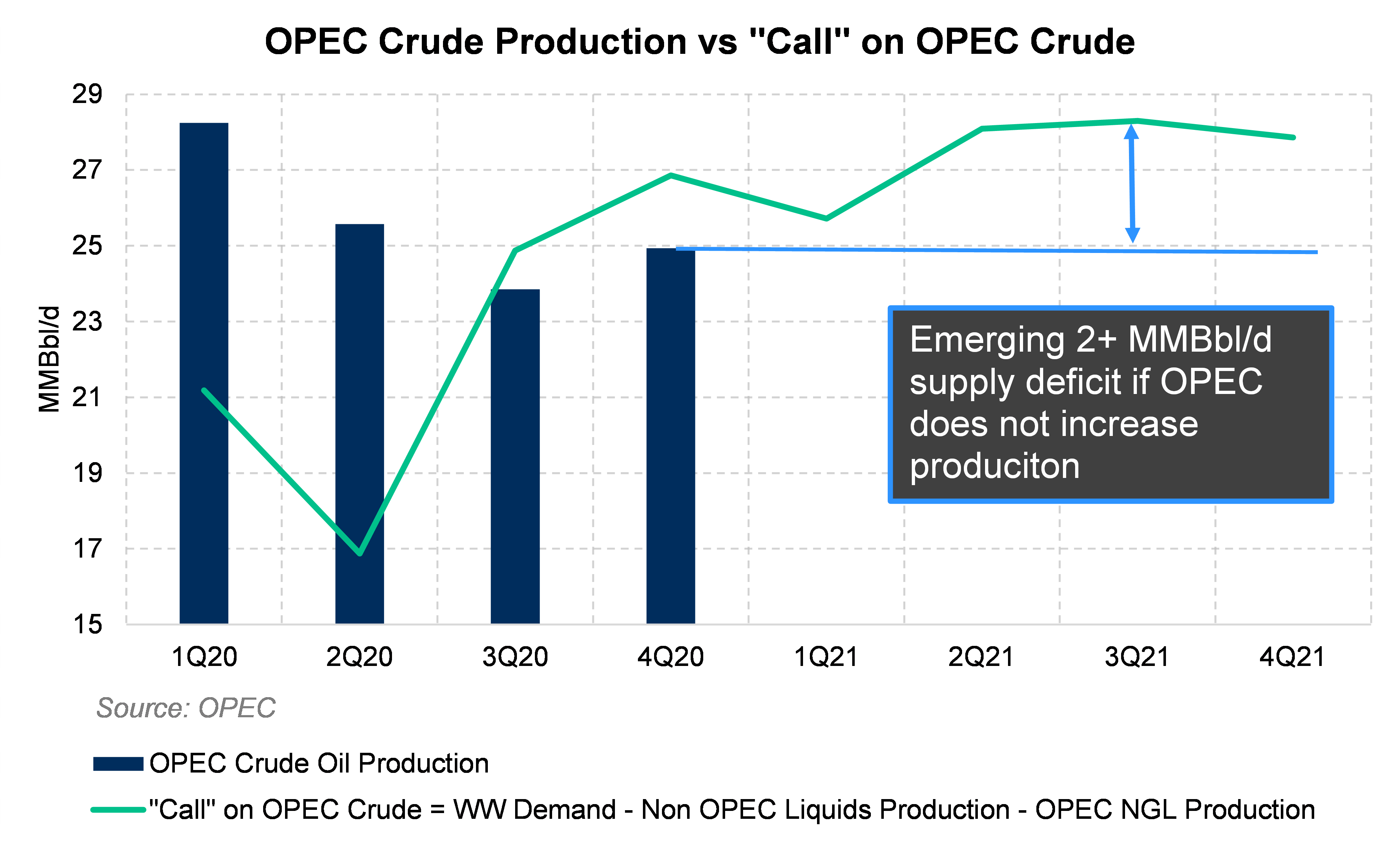

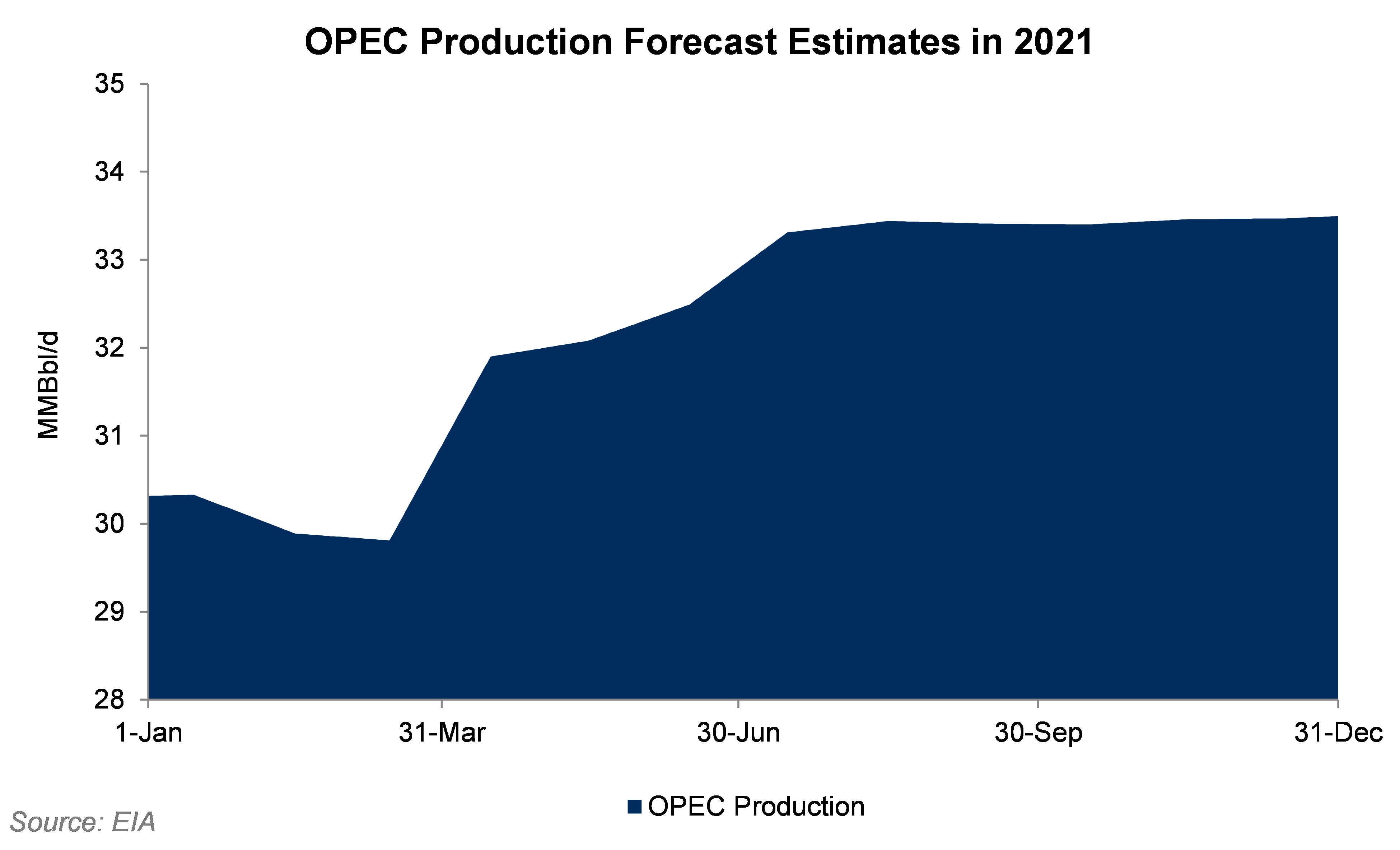

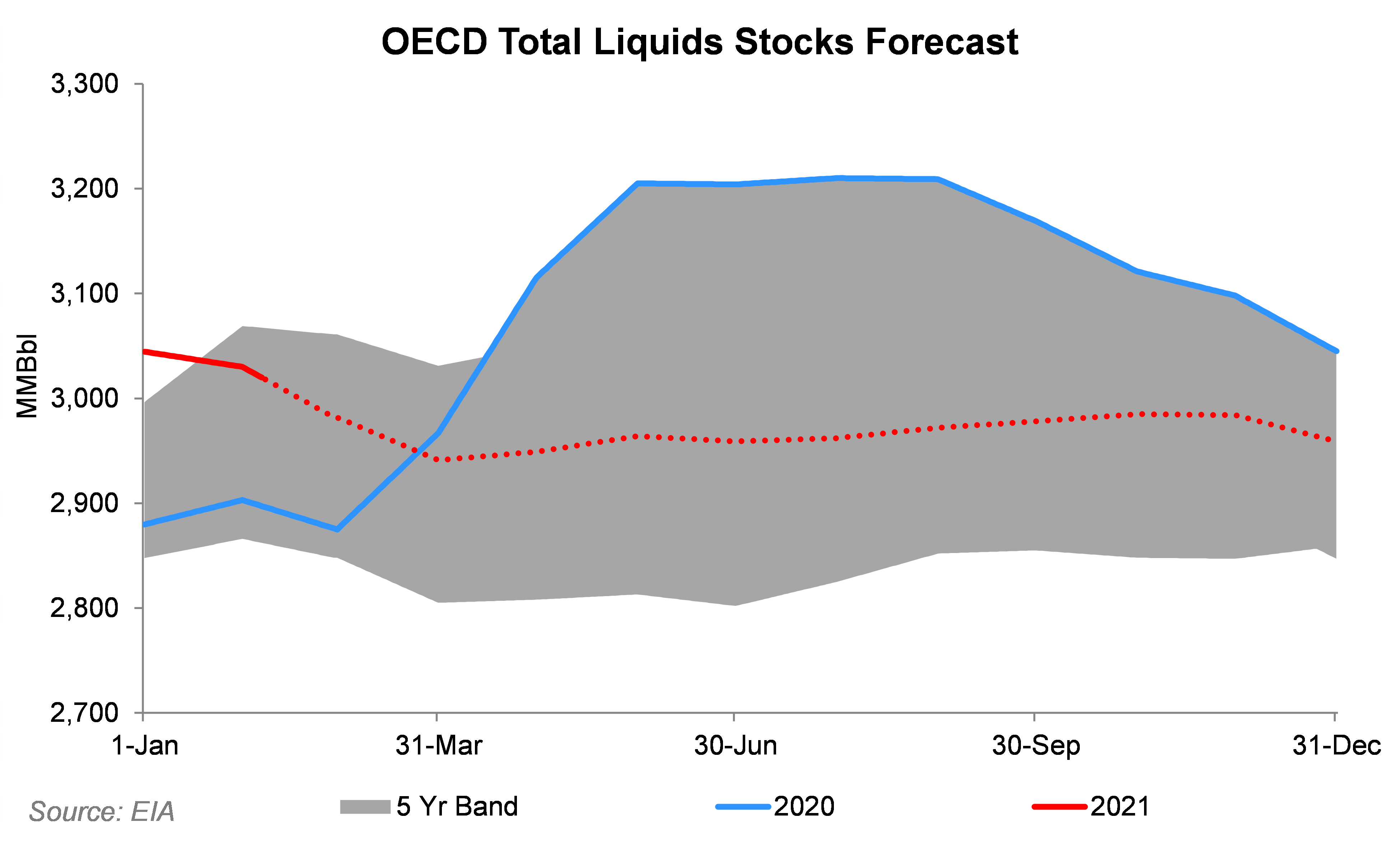

The three major agencies (EIA, IEA, OPEC) released their monthly reports this week, and each marginally cut 2021 worldwide demand growth estimates from the prior month. However, the bigger picture is that OPEC+ is firmly in control of the market; a supply shortfall is likely if the cartel does not increase production. The graph above is from OPEC's Monthly Oil Market Monitor ("MOMR") published on February 11. It tells the key story for the oil market outlook for 2021. Markets have been in deficit since the second half of 2020, and that deficit looks likely to expand significantly without a relaxation of OPEC cuts in the coming months.OPEC+ Supply Increases Are Expected ImminentlyWith the rally in prices, analysts expect OPEC to turn the taps back on in coming months and move the oil market towards a balanced state. The EIA published its Short Term Energy Outlook ("STEO") this week on February 9. The charts below show how the EIA expects a current drawdown in OECD stocks to cease once OPEC increases production in March.

The graph above is from OPEC's Monthly Oil Market Monitor ("MOMR") published on February 11. It tells the key story for the oil market outlook for 2021. Markets have been in deficit since the second half of 2020, and that deficit looks likely to expand significantly without a relaxation of OPEC cuts in the coming months.OPEC+ Supply Increases Are Expected ImminentlyWith the rally in prices, analysts expect OPEC to turn the taps back on in coming months and move the oil market towards a balanced state. The EIA published its Short Term Energy Outlook ("STEO") this week on February 9. The charts below show how the EIA expects a current drawdown in OECD stocks to cease once OPEC increases production in March.

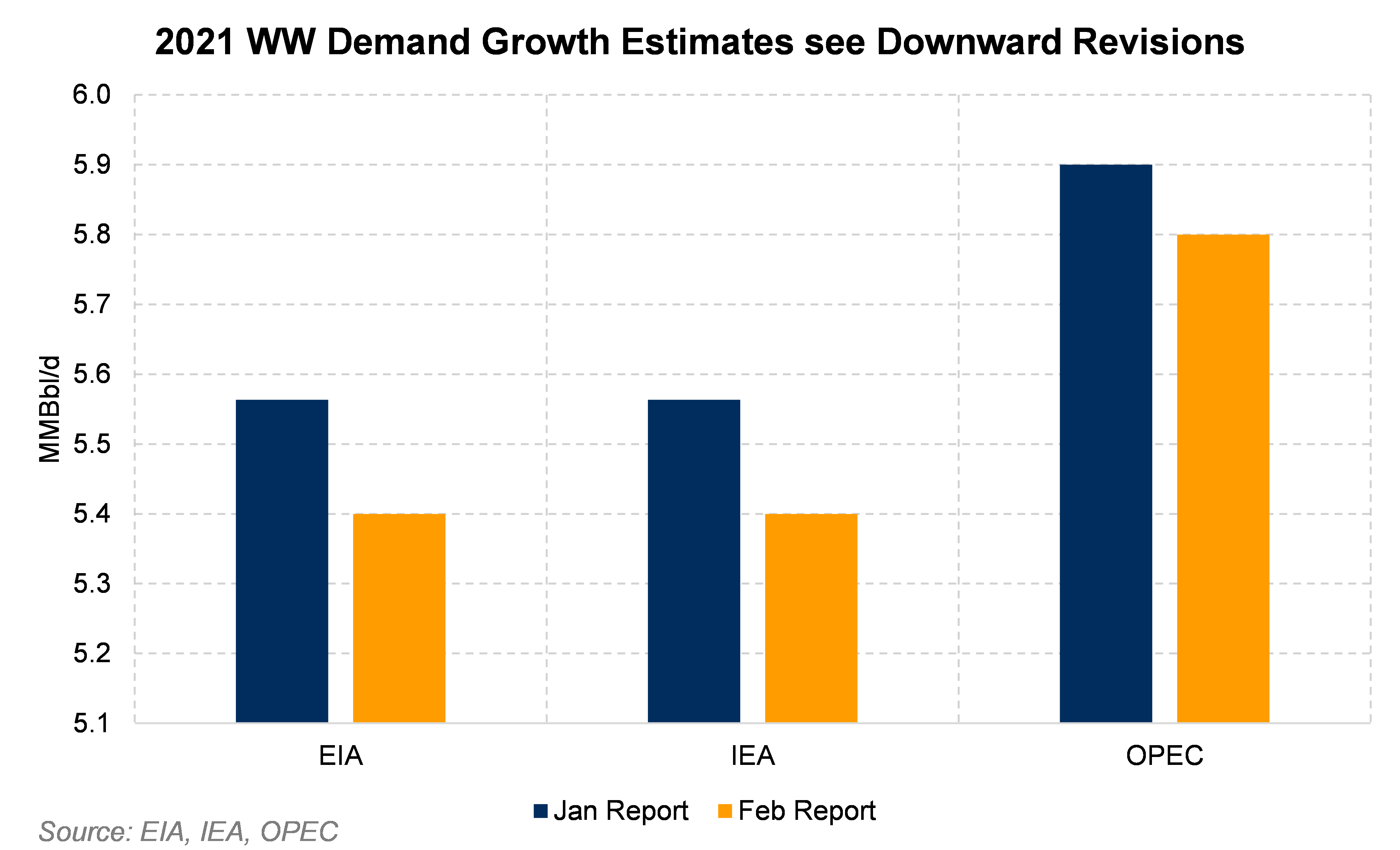

Demand Concerns Are Receding While Supply Takes Center StageThe EIA, IEA, and OPEC all cut worldwide crude demand estimates for 2021 relative to their January outlooks, but by small amounts, 100-200 MBbl/d. The demand forecast cuts made headlines, but the market shrugged off the news, with crude closing at new year-to-date highs on Friday, February 12.

Demand Concerns Are Receding While Supply Takes Center StageThe EIA, IEA, and OPEC all cut worldwide crude demand estimates for 2021 relative to their January outlooks, but by small amounts, 100-200 MBbl/d. The demand forecast cuts made headlines, but the market shrugged off the news, with crude closing at new year-to-date highs on Friday, February 12. Why might the market be less concerned with lower demand forecasts from the major agencies?

Why might the market be less concerned with lower demand forecasts from the major agencies?

While lockdowns, or restricted activity, are still commonplace as Covid countermeasures in many parts of the world, oil demand is growing again in many areas.

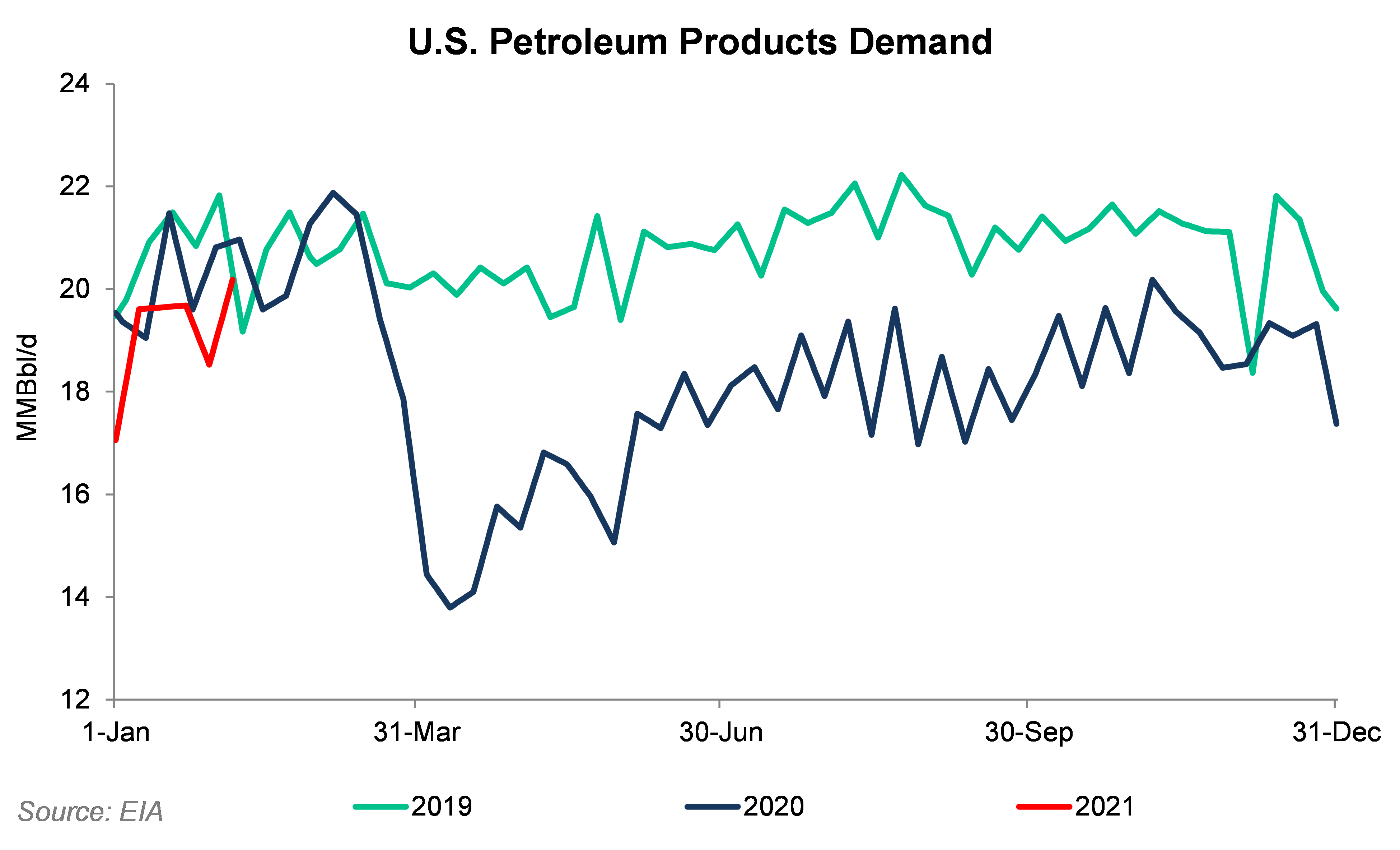

Looking at domestic demand for petroleum products, the U.S. appears to have re-entered normal demand territory when compared to year-ago levels. Year-to-date demand trends have been bullish, and deployments of the vaccines to Covid have just begun. SummaryThe oil market is in deficit and global OECD crude and product stocks are currently drawing at a vigorous pace. Demand concerns appear to be fading into the background for traders.

SummaryThe oil market is in deficit and global OECD crude and product stocks are currently drawing at a vigorous pace. Demand concerns appear to be fading into the background for traders.

The EIA expects OPEC to turn on the taps in March. If the cartel were to put off that decision for a few months, based on current fundamentals, OECD crude and product stocks would continue drawing and move towards the lower end of their five-year band.

All eyes in the oil market will be focused on OPEC's next meeting set for March 3. After a historic year, OPEC+ has control of the market once again, and the ball is in their court.