|

Gasoline and diesel prices have surged to fresh record highs in recent weeks and have hurt companies exposed to floating price risk. Demand for petroleum products has been ticking higher lately, approaching pre-pandemic highs. In contrast, U.S. refining capacity has decreased as several refineries have closed since the pandemic. As a result, product prices and crack spreads have surged to record levels, and the pain may not be over yet. |

|

|

The chart above shows the New York Ultra-Low Sulfur Diesel (ULSD) and Reformulated Blendstock for Oxygenate Blending (RBOB) prices and cracks. Cracks, as we have calculated them, are the simple difference in price between the two products, after converting to dollars per gallon. Cracks can also be described as the gross margin in refining a gallon of crude into a gallon of gasoline or diesel. When the product price rises faster than the crude oil price, the crack widens, or gets larger. These cracks are important because they signal to refiners that more of a particular fuel is needed. The shortage of ULSD and RBOB products has led both prices to hit record highs in the last several weeks, vastly outpacing the price increases of crude oil. |

|

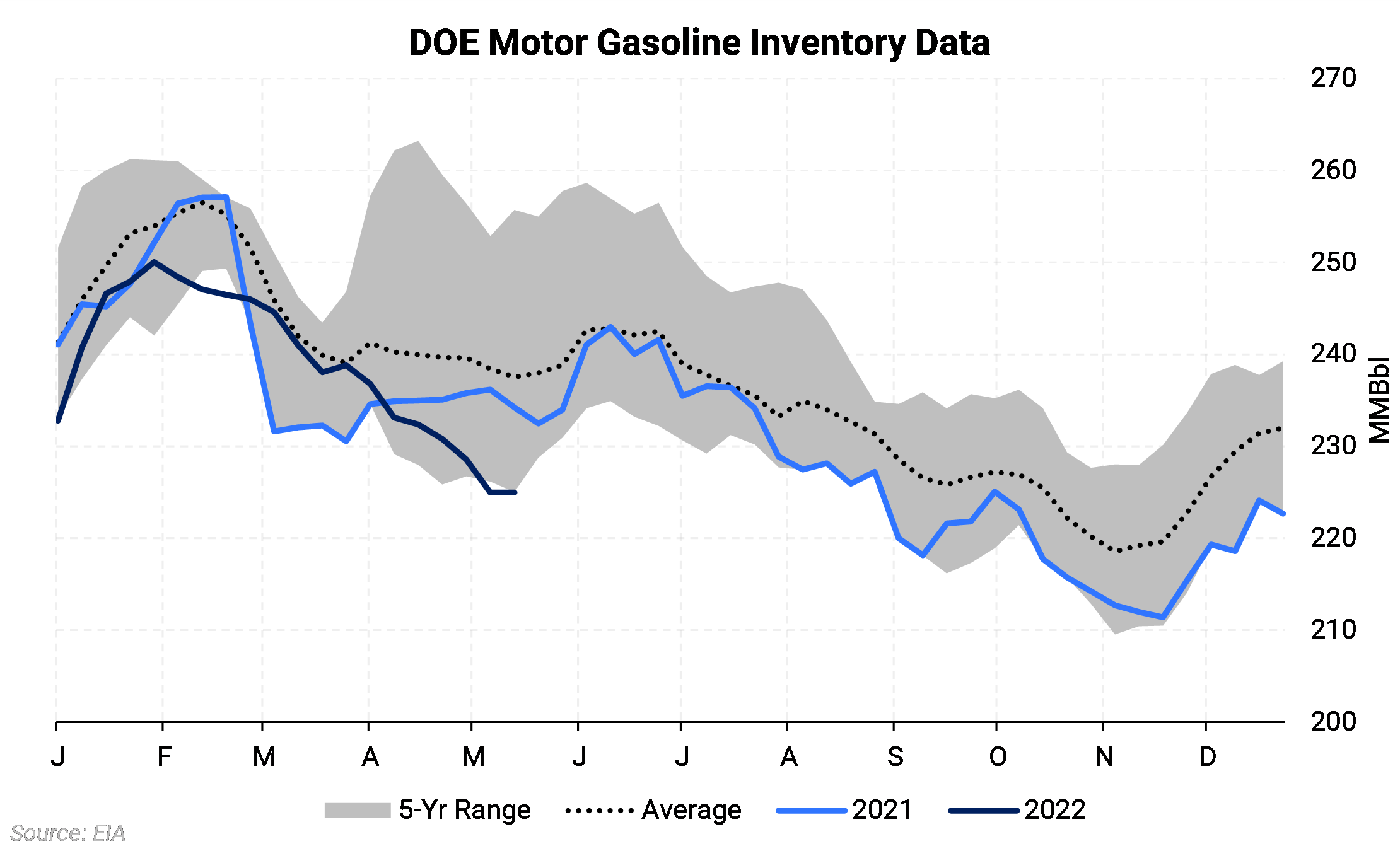

GASOLINE & DIESEL FUNDAMENTALS Motor gasoline inventory levels are at their lowest for this time of year, since 2010. However, that was over 25 days of supply then, whereas now it is only around 23. The low inventory levels, lower U.S. refining capacity, and recovering demand mean that risks are likely skewed to the upside for the gasoline market in the near term. U.S. gasoline demand is very seasonal and it peaks during July, usually. Furthermore, refining capacity is insufficient to fulfill peak gasoline demand during the "driving" season. Refining capacity is insufficient because they still need to produce enough diesel and jet fuel to keep those markets in check, making gasoline inventories vital during the summer. |

|

|

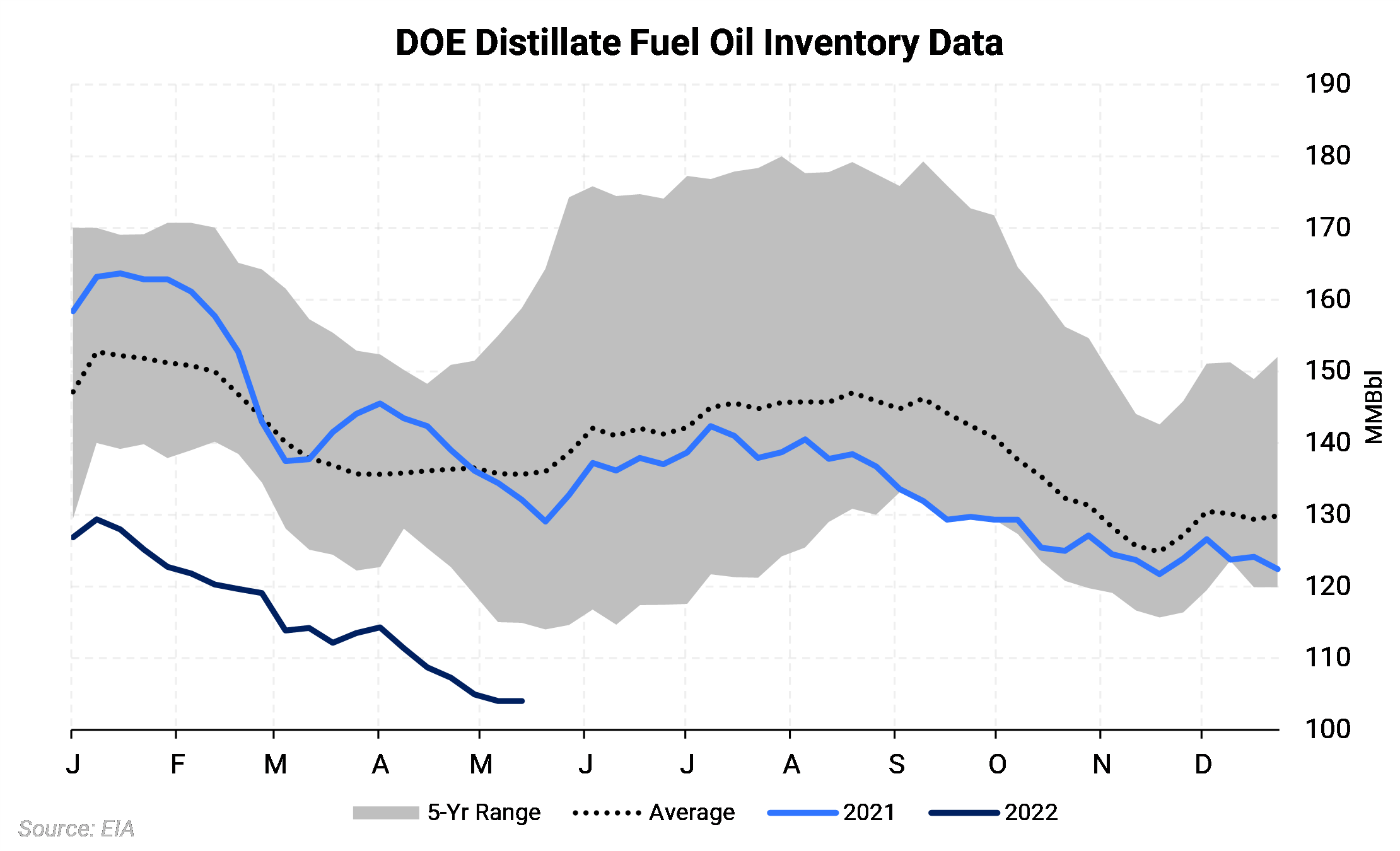

In addition, diesel prices had reached an all-time high a couple of weeks ago, surpassing $5/gal (top chart) for the first time since the contract's inception, as demand peaks and supply remains inadequate, leading to increasing pulls from inventories. Distillate inventories are at their lowest level since 2008, and NY ULSD’s strength has been exacerbated by the fact that the delivery point for the CME ULSD contract in New York Harbor, and PADD 1 (East Coast), inventories are far below normal levels. |

|

Refined product prices are all interdependent because of the limited capacity of U.S. refiners. To produce more gasoline, you would have to sacrifice diesel and jet fuel output, which means that those markets become tighter. So in many ways, the refineries have to stay in tune with several different markets simultaneously to keep them balanced. So, if one product crack yields more than another, refiners will alter operations to maximize margins if able.

Conclusion

Gasoline and diesel demand may be more elastic or responsive to prices, which could help soften the market, but there hasn't been any recent data to confirm. However, when adjusting for inflation, these product prices are not at all-time highs and may signal that demand could be more resilient to price spikes than in the past or have more upside before demand destruction occurs.

If it turns out that there is a true lack of refining capacity in the U.S. (read more here), then that could spell higher gasoline and diesel prices for a while, years even. Fortunately, backwardated markets provide an excellent opportunity for consumers to lock in a lower price to protect themselves from future price spikes. If you have any questions regarding how AEGIS can help your company protect itself from floating price risk during this time of unprecedented volatility, reach out to info@aegis-hedging.com

Commodity Interest Trading involves risk and, therefore, is not appropriate for all persons; failure to manage commercial risk by engaging in some form of hedging also involves risk. Past performance is not necessarily indicative of future results. There is no guarantee that hedge program objectives will be achieved. Certain information contained in this research may constitute forward-looking terminology, such as "edge," "advantage," 'opportunity," "believe," or other variations thereon or comparable terminology. Such statements and opinions are not guarantees of future performance or activities. Neither this trading advisor nor any of its trading principals offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program.